Tory strategy: to hope for a credit downgrade

5:54 pm - December 30th 2009

| Tweet | Share on Tumblr |

I smiled a rueful smile when I heard David Cameron call for a ‘good clean fight’ in the forthcoming general election.

Let’s set aside for the moment the fact by pouring millions of Lord Ashcroft mega-wealth into marginal constituencies, the Conservatives are effectively buying up seats, while having the gall to suggest that it is the Labour party that prey to the agenda of its key financial backers.

What is new this time around is that the result of the election may be decided on the basis of a single, methodologically obscure decision by a single credit ratings analyst.

Let’s let Stephanie Flanders take up the story, in her ‘intriguing question for 2010’:

Everyone thinks that the markets will politely wait until Britain has gone to the polls to draw its verdict on the UK. Well, maybe. But if sovereign debt is indeed the new sub-prime – at least where the markets are concerned – it’s difficult to believe that Britain will get through the months before the election without at least one major market wobble.

Perhaps one ratings agency will put the UK on negative watch. Or investors will get seized with the idea of a hung Parliament. Or Britain will simply get caught in the crosshairs of a market panic over sovereign debt in Central and Eastern Europe. Who knows what the trigger will be. But my hunch is there will be something, this side of polling day. The question will be how the major political parties react.

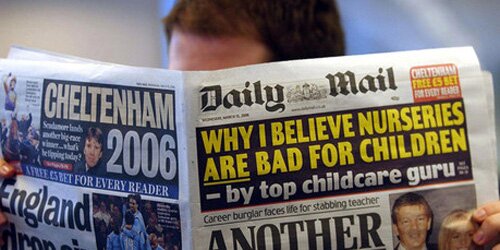

In fact, the Conservative party is already reacting to the possibility of a ratings downgrade as part of its pre-election hype. Here’s George Osborne in the Telegraph just before Christmas:

It is clear that 2010 will be the year when the world’s focus shifts from the debts in our banks to the enormous debts being run up by governments. The last month has seen a crucial change, beginning with Dubai and followed by Greece, Ireland and Spain, in the way that international investors perceive the riskiness of sovereign debt and the sustainability of public finances. On this count, the credit-rating agencies have singled out Britain as the most vulnerable of any top-rated country, with the biggest budget deficit in the G20.’

While this may not in fact be true (the US is placed in the same ‘resilient’ rather than resistant’ category by Moody’s), such technicalities are unimportant in the general narrative.

While they can’t go as far as express support for downgrading, you can bet your bottom dollar that behind closed doors they’re hoping that it will come early in the New Year, in the context of the ‘panic’ factors that Stephanie Flanders alludes to.

For Labour, the response is trickier, and it’s even possible to sympathise with them in their predicament. If they make too many signals to the markets and the rating agencies about plans for cutting the deficit (in the budget, assuming a May election), they risk abandoning their new class-focused narrative which looks like it may serve them well. If they don’t do that, they risk a downgrade just weeks before polling day.

What Labour needs to do is take the bull by the horns, and attack the Tories and Cameron around their ‘good, clean fight claims’, as part of their evolving ‘them vs. us’ election narrative, but to imbue that narrative with the message that not only are the Tories just out for themselves and their own class, they’re also prepared to sacrifice the very spirit of democracy to get the power they want.

But the bigger story Labour can create, if it has the political will, is the one around the way a small set of anonymous financial analysts, from mega-earning firms that just twelve months ago were pinpointed as having caused the greatest financial crisis since 1929, are now in a position to undermine British democracy. As Peter Apps of Reuters says:

A year ago, they were being blamed for the financial crisis. Now, the three credit rating agencies are emerging as new powerhouses in European politics, driving policy as governments face record deficits.

Even more saliently, from the same article, Steve Shifferes (Professor of Financial Journalism at City University) says:

It is not that they necessarily know more than any other analysts. But because the credit rating is such an easy thing to focus on, they have much more power. It’s not very democratic.

Absolutely. It’s not very democratic. It’s not Cameron’s ‘good, clean fight’.

Labour would do well to remind people that Cameron is a liar to suggest that he wants any such thing, when many his party’s efforts are directed at subverting the democratic process.

| Tweet | Share on Tumblr |  |

Paul Cotterill is a regular contributor, and blogs more regularly at Though Cowards Flinch, an established leftwing blog and emergent think-tank. He currently has fingers in more pies than he has fingers, including disability caselaw, childcare social enterprise, and cricket.

· Other posts by Paul Cotterill

Story Filed Under: Blog ,Conservative Party ,Economy ,Labour party ,Media ,Westminster

Sorry, the comment form is closed at this time.

Reader comments

The Ashcroft money is going into the most marginal seats so that the Conservatives have more results in the bank when the election is called. It will liberate more resources and manpower to the less marginal seats, allowing them to run a more flexible campaign. There is nothing wrong or immoral about the strategy, and the word “dirty” can only be used to question the source of funds. If the money came from a transparent source, the only concern would be whether politics costs too much, but that concern applies equally to elections that the Conservatives have lost.

It is ridiculous to suggest that the Conservatives welcome or encourage an immediate lowering of the UK’s credit rating. They may be called the stupid party, but they aren’t that daft. George Osborne aspires to be Chancellor this coming summer, and he knows that he will need to borrow money. At the best interest rate.

Osborne’s message in the Telegraph article was intended to scare UK voters who might consider backing Labour. All of GO’s bad things are going to happen if the UK elects another Labour government. According to the GO hypothesis, those bad things will not occur before the next election (even under the current government) but the only way to sustain that situation is to elect a Conservative government.

Cobblers, of course, but in no way subversive.

It’s not very democratic, but the business of paying one’s way through the world is rarely “democratic”.

“It’s your tree, Frank, you’re sitting in it”.

Don’t blame the Conservatives for the predicament you’ve created for yourselves.

“Absolutely. It’s not very democratic.”

So… we should decide a country’s fiscal health by a poll of some kind? “Is Britain.. lik doing well wiv money and stuff?” Totally lost as to the point of that section.

. Priceless to see Osbourne banging on about govt debt when the first thing he intends to do is cut inheritance tax for the wealthy middle classes. The debt is either a massive problem that requires austerity measures or it is not. You can’t be for both.

Always remember that the tories are always lecturing people that you can’t solve problems by throwing money at them. But of course this only applies to poor people.

I will stop asking for money to be thrown at poor peoples problems when the rich stop throwing money at their problems

I’m not sure what point you are trying to make, that the conservatives are hoping for bad pre-election news on the economy (well I never), that rating agencies are charlatans (again, knock me down with a feather) or that the markets should be made to wait until after the election to make a decision about sovreign debt (er, Gordo may be the master of many things, but patently not the markets).

IMHO the markets are expecting a tory win, if the polls start to move towards lab or hung they will react badly.

For an informed perspective, compare the public debt levels of G7 economies, based on IMF data, shown in the bar chart in this recent news report about France’s public debt:

http://news.bbc.co.uk/1/hi/business/8434545.stm

Honestly, I don’t know what was expected. Labour have been pulling the wool over people’s eyes since they came to office. For the past decade we’ve had roughly Tory levels of taxes and Labour levels of spending (with the gap filled with borrowing) because Labour knew the public wouldn’t stand for the tax rises needed to pay for the spending they wanted.

This tactic can only work for so long. Eventually, those lending the money start to ask questions. That’s now happening. I don’t want Britain’s credit rating to be downgraded, the consequences of that will be severe, but if it happens, I know who’s to blame. If it doesn’t happen, well I still know who put us in a position that led to questions being asked.

2007 is the latest year for which I could find accessible, comparable data for General Government Expenditure as a percentage of national GDP for selected OECD countries:

http://micpohling.wordpress.com/2008/07/03/oecd-general-government-expenditure-of-gdp-2007/

The UK comes in at 44.6 per cent of GDP compared with, say, France at 53.0 per cent.

The Institute for Fiscal Studies (IFS) is the independent oracle source on the state of public finances in Britain. The latest IFS bulletin on the state of Britain’s public finances, published this month, is here:

http://www.ifs.org.uk/pr/pubfin_dec09.pdf

For longer term perspectives by the IFS, try:

A survey of public spending in the UK

http://www.ifs.org.uk/publications/1791

A survey of the UK tax system

http://www.ifs.org.uk/publications/1711

I worked in sovereign debt markets for 25 years and the hysteria in the UK press is ridiculous. No matter what narrative the Tories peddle there is no imminent threat to the UK credit rating. The idea that the financial markets are praying for a Tory win is fanciful. The markets made up their mind on G. Osborne at the end of last year and quickly concluded that he was clueless. Contrary to the media narrative the markets would prefer a hung parliament as that puts them in charge rather than the politicians.

Credit ratings are more than just the level of fiscal deficit and the ratio of debt to GDP.

Political stability.

Historical record of default.

Average maturity of the tradeable debt.

Historical record of reducing deficits.

Independence of the central bank and their credibility in controlling inflation.

Those are just some of the factors that the credit reference agencies consider when rating sovereign debt. For some nations a 5% fiscal deficit would lead to a downgrade. However, other nations with a good historical record of deficit reduction could run a double digit deficit without a downgrade. That is why one hears constantly the talk of credibility. To be credible, Darling should have done more to specify where his cuts would fall.

Gilt yields are on the rise and will continue to rise next year. However, this is a sign that the economy is improving and money is leaving risk-free assets looking for a better return. The average maturity on UK debt is falling slightly but it is one of the highest maturity in the world. What is risky is when a nation relies on short-term debt and constantly needs to keep rolling it over. That is not the case with UK debt. There is absolutely no evidence that the Debt Management Office have any difficulty in selling gilts. All the auctions are well over subscribed.

The UK does not have a national debt problem. What it does have is a fiscal deficit problem. Darling should have done more to make clear how this deficit would be reduced in the future.

One other factor with the credit reference agencies with regard to the UK rating is the US rating. There would be no credible argument for downgrading the UK and not the US. A downgrade for the US would lead to absolute carnage throughout the world. It is far from certain that the credit reference agencies would want to go there.

Sorry, didn’t realise Sunny had cross-posted this from http://thoughcowardsflinch.com/2009/12/30/will-the-british-electorate-decide-who-runs-the-country-in-2010/, where there’s a parallel debate starting up.

Richard @10: Those are a really useful set of observations. your observation about how the UK cannot be logically downgraded if the US is not (and the carnage that would ensue if the US were downgraded) mirrors what Martin Wolf was saying in the FT a couple of weeks back. Certainly I’d have agreed a few weeks back that a downgrading was unlikely for the reasons you set out, but it does seem that a different set of considerations may be coming into play, and this is what drives Stephanie Flanders’ suspicion of a major event in early 2010.

Will come back to other stuff later, and likely as not in a separate post picking up some of these observations and those at TCF which are allied.

Interesting that you suggest the conservatives maybe playing politics with nations finance. This is an accusation that has been made by many (an in my oppinion rightly) against the current government. The markets are holding there breath, hoping for Conservative victory. The prospect of hung parliament will really scare the markets, it will suggest to them that decisive action to solve the UK’s financial problems will not be forethcoming. A convincing victory (either way) is what the markets are calling for.

Now that certain elements of New Labour, notably Brown & the public school educated Balls are campaigning on Class hatred no more preaching from them please about Race hatred and the BNP.

Pots & keetles? .

@12, no, what you’re doing there is confusing “the markets” with “the ignorant right-wing tossers who think that owning Wall Street on DVD means they understand Finance And That”. Richard @10 provides a comprehensive demonstration of why your theory is nonsense.

> What is new this time around is that the result of the election may be decided on

> the basis of a single, methodologically obscure decision by a single credit

> ratings analyst.

The market – which is to say, vast numbers of people putting their money where their mouths are – respond to what they see. The agencies, in parallel, do the same. There is cross-over between the two; the market pays attention to agencies, agencies pay attention to the market.

To present this as ‘a single individual, basically make it up in whatway the agency sees fit, lowering a rating’ is *entirely and absolutely absurd and deliberately misleading*.

troll “The market – which is to say, vast numbers of people putting their money where their mouths are – respond to what they see.”

No, a few very rich people put their money where their mouths are and fuck it up for everyone else.

But also it’s fun to see the tories talk the UK down. They always do when they are out of power because they think they have a divine right to govern.

An opposition party wants things to go badly in the five months before an election to make their victory more likely? Whodathunkit.

You say it’s not democratic for our political future to hang in the balance of credit ratings agencies, but who asked us before promising decades of future tax revenues to international lenders? Who asked us before contracting so much debt that we have become beholden to these external forces? Who asked us?

Labour party policy has been the real anti-democratic force here.

” who asked us before promising decades of future tax revenues to international lenders? Who asked us before contracting so much debt that we have become beholden to these external forces?”

So the Northern Rock, RBS and HBOS banks in Britain should have been allowed to sink into insolvency with their depositers losing all their balances?

I think we should know exactly if that is the line a Conservative government would take should there be another banking crisis when it is in office.

It really isn’t credible to claim the financial crisis is all due to the Labour government when severe recessions have afflicted other G7 economies and a long and sorry list of banks in America had to be bailed out by the US federal government. The persistence with which the Conservative mendacious spin is churned out leads me to discount all commentary by the Conservative Party, its members, friends and supporting media.

2007 is the latest year for which I could find accessible, comparable data for General Government Expenditure as a percentage of national GDP for selected OECD countries:

http://micpohling.wordpress.com/2008/07/03/oecd-general-government-expenditure-of-gdp-2007/

The UK comes in at 44.6 per cent compared with, say, France at 53.0 per cent.

I regard the Institute for Fiscal Studies (IFS) as an independent oracle source on the state of public finances in Britain. Its latest bulletin on Britain’s public finances, published this month, is here:

http://www.ifs.org.uk/pr/pubfin_dec09.pdf

“It really isn’t credible to claim the financial crisis is all due to the Labour government when severe recessions have afflicted other G7 economies and a long and sorry list of banks in America had to be bailed out by the US federal government.”

WORD!

I am still waiting for the tory brownshirts to explain to me when Gordon Brown was running all the American banks that have gone bust. Or AIG the Insurance firm that has been bailed out. When was Brown running General motors or the Irish and Scandinavian bank? If the moon fell from the sky some jerk would show up here to blame him for tje fall.

Browns fault, was that he and New Labour carried on the pathetic self regulation (no regulation) that was put in place by the International right wing in the 80s and 90s. But that of course does not fit with the trolls whinge that Brown is a red in claw socialist.

Bob

So the Northern Rock, RBS and HBOS banks in Britain should have been allowed to sink into insolvency with their depositers losing all their balances?

The policy options were not either do what the Government did or let the banks go bust. There were many other options that would probably have been better. Eg not forcing the merger of Lloyds and HBOS – a cardinally stupid error for both Lloyds and everyone concerned. The NR depositors could have been compensated – above the legal level if necessary….

There were other options…plkease do nopt be so disingenuous and trot out your figures again.

Brown is solidly to blame for the regulatory and box-ticking fiasco that allowed HBOSD and NR to indulge in such unsound banking practices. Was he not the person who created that regime?

“not forcing the merger of Lloyds and HBOS – a cardinally stupid error for both Lloyds and everyone concerned.”

Last January, I suggested to the manager of my local Lloyds Bank branch that the then proposed merger with HBOS wasn’t a good idea. He shook his head in disagreement.

The fact is that the hierarchy and management of Lloyds Bank really wanted the merger because they saw it as virtually the only means of shortly becoming the UK’s largest retail bank on high streets – the bank pressed the government to waive the competition policy rules which had previously blocked Lloyds from making a bid for HBOS and the government duly obliged.

From the government’s perspective, the merger with the troubled HBOS bank was the quickest way of passing on to Lloyds Bank what would otherwise have been yet another severe headache for the Treasury – in addition to the headaches it already had from the failed Northern Rock and RBS banks.

“Brown is solidly to blame for the regulatory and box-ticking fiasco that allowed HBOSD and NR to indulge in such unsound banking practices. Was he not the person who created that regime?”

Sure, the regulatory regime for banks should have been much tougher but then the Conservatives and their friends kept extolling the benefits of Free Market Capitalism and urging the government to cut Red Tape and Deregulate. As I recall, John Redwood was even given the brief of Deregulation for his shadow portfolio. Now FWIW I’ve been posting for years that the notion of self-regulating and self-correcting free markets is a demonstrable nonsense but then I come from the keynesian tradition.

Just in case you think I’ve got this all wrong, try Alan Greenspan’s testimony on 24 October 2008 to the US House of Representatives Oversight Committee:

“Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief.”

http://online.wsj.com/article/SB122476545437862295.html

For comparison with what happened in the US:

“Economist and columnist Paul Krugman recently dubbed the [last] decade ‘The Big Zero,’ an era in which the US gained virtually zero jobs, the typical US family made zero economic progress, and stock prices failed to rise.”

http://www.csmonitor.com/USA/2009/1231/New-Year-s-name-game-00s-were-the-Downhill-Decade

George W Bush became the US Republican President in January 2001 and stepped down as President in January 2009.

Btw I’ve lost track of how many US banks failed in the recent financial crisis and had to be bailed out by the US federal government. Was all that due to Gordon Brown too? And the severe recessions in the other G7 economies?

A happy and prosperous new year to all readers.

Some friendly advice for Conservative supporters here and elsewhere:

It’s unwise to assume that everyone else can be safely regarded as ignorant, gullible fools who can be relied on to swallow Conservative spin regardless.

Some of us recall that shrewd insight of Hitler:

“The great masses of the people will more easily fall victims to a big lie than to a small one.” [Mein Kampf]

Irrefutable Proof ICTY Is Corrupt Court/Irrefutable Proof the Hague Court Cannot Legitimately Prosecute Karadzic Case

http://picasaweb.google.com/lpcyusa/

(The Documentary Secret United Nations ICC Meeting Papers Scanned Images)

This legal technicality indicates the Hague must dismiss charges against Dr Karadzic and others awaiting trials in the Hague jail; like it or not.

Unfortunately for the Signatures Of the Rome Statute United Nations member states instituting the ICC & ICTY housed at the Hague, insofar as the, Radovan Karadzic, as with the other Hague cases awaiting trial there, I personally witnessed these United Nations member states openly speaking about trading judicial appointments and verdicts for financial funding when I attended the 2001 ICC Preparatory Meetings at the UN in Manhattan making the iCTY and ICC morally incapable trying Radovan Karazdic and others.

I witnessed with my own eyes and ears when attending the 2001 Preparatory Meetings to establish an newly emergent International Criminal Court, the exact caliber of criminal corruption running so very deeply at the Hague, that it was a perfectly viable topic of legitimate conversation in those meetings I attended to debate trading verdicts AND judicial appointments, for monetary funding.

Jilly wrote:*The rep from Spain became distraught and when her country’s proposal was not taken to well by the chair of the meeting , then Spain argued in a particularly loud and noticably strongly vocal manner, “Spain (my country) strongly believes if we contribute most financial support to the Hague’s highest court, that ought to give us and other countries feeding it financially MORE direct power over its decisions.”

((((((((((((((((((((((((( ((((((((((((((((((((((((( Instead of censoring the country representative from Spain for even bringing up this unjust, illegal and unfair judicial idea of bribery for international judicial verdicts and judicial appointments, all country representatives present in the meeting that day all treated the Spain proposition as a ”totally legitimate topic” discussed and debated it between each other for some time. I was quite shocked!

The idea was “let’s discuss it.” “It’s a great topic to discuss.”

Some countries agreed with Spain’s propositions while others did not. The point here is, bribery for judicial verdicts and judicial appointments was treated as a totally legitimate topic instead of an illegitimate toic which it is in the meeting that I attended in 2001 that day to establish the ground work for a newly emergent international criminal court.))))))))))))))))))))))))))))

In particular., since “Spain” was so overtly unafraid in bringing up this topic of trading financial funding the ICC for influence over its future judicial appointments and verdicts in front of every other UN member state present that day at the UN, “Spain” must have already known by previous experience the topic of bribery was “socially acceptable” for conversation that day. They must have previously spoke about bribing the ICTY and

ICC before in meetings; this is my take an international sociological honor student. SPAIN’s diplomatic gesture of international justice insofar as, Serbia, in all of this is, disgusting morally!

SPAIN HAS TAUGHT THE WORLD THE TRUE DEFINITION OF AN

“INTERNATIONAL CRIMINAL COURT.”

I remind everyone, when I attended those ICC Preparatory Meetings in 2001, witnessing first hand the country plenipotentiary representatives present with me discussing so openly, trading judicial funding of a new international criminal court, for its direct judicial appointments and judicial verdicts, those same state powers were

concurrently,

those same countries and people were already simultaneously, funding the already established ICTY which was issuing at that time, arrest warrants for Bosnian Serbs under false primary diplomatic pretenses.

The ICTY and ICC is just where it should be for once. Cornered and backed into and an international wall, scared like a corned animal (and I bet it reacts in the same way a rabid cornered animal does too in such circumstances). (ICTY associates)

http://picasaweb.google.com/lpcyusa

(Documents: Hague war crimes tribunal for the former Yugoslavia (ICTY) has destroyed all material evidence about the monsterous KLA Albanian/KLA organ trade in Kosovo).

I believe strongly that ICYU assocaites murdered former Serb President, Slobodan Milosevic, tried to murder me, as well and other Serbs prisoners and presently places , Doctor Radovan Karadzic’s life in direct danger as well as Ratko Mladic’s life

in danger should he be brought there.

The ICTY has no other choice than to halt all further court proceedings against, Doctor Radovan Karadzic, and others there both serving sentences and awaiting trials. Miss JIll Louise Starr (The UN Security Council has no choice but to act on this now).

I accuse the Hague ICTY war crimes tribunal of attempted assassination on my life and others, contempt of court and obstruction of international justice and “international witness tampering” in complicity with Richard Holbrook and Bill Clinton (Former US President of the USA) as well as political playersin Spain and the Netherlands .

I represented the state interests’ of the Former Yugoslavia, in Darko Trifunovic’s absence in those meetings and I am proud to undertake this effort on Serbia’s behalf.

If Labour as a government are a car crash, the Tories are the mini they’ve collided with.

Both Parties are absolute write-offs.

I have to laugh at Tory voters who think an election victory for them this year will usher in some radical and glorious rightwing utopia. There is no such thing. Conservatism, like socialism, is bunk.

European Social Democracy with market economies subject to active government influence is where it is at. It may take 5 years of Osbourne and Co stuffing things up (as they are sure to do) for the British voting public to remember this.

Lets dispela few myths here;

#8 Bob M

Lets compare apples with apples. For example, Japan’s national debt *includes* fully funded pulic sector pensions. The UK’s public sector pension are wholly unfunded (i.e. there is no provision for them apart from current taxtion). If you include these pensions and things such as PFI, you add about £1.2 trillion to the level of government debt. Which takes us up to around 200% of GDP.

#16 Sally

I’m not sure you know how financial markets work. Thousands of people, making investment decisions for themselves and on behalf of others. Your pension, for example. No-one is going out to “fuck things up” for anyone else, they are making judgements based on what they see as the best available data.

Generally;

The UK’s fiscal situation is disastrous, thanks to a continued overspend from the government over the last 10 years, in a period of good growth. To put it into perspective, Tax revenues are around £500bn, yet the government spent £680bn this year. Debt servicing is currently $35bn, but is set to grow to somewhere around £85bn by 2015 on Labour’s current spending plans (see PBR).

To put that into perspective, defence spending is £35bn, and £80bn is roughly the education budget.

There is no “cuts v growth” argument. You simply can’t grow your way out of a hole that big. Whichever party is in power next year will be forced to make massive cuts. As an aside, high deficit countries tend to experience sub-par growth, as their marginal tax rates are forced higher. Its a viscious circle.

As for rating agencies – the press give them too much credit. They are reactive – they will never pre-empt a downgrade. Any action they take is a result of observable deterioration in finances. The market isn’t dumb, and will tend to be well ahead of any news the rating agencies may give – GIlt yields are already heading higher. So much so, that yields are already higher than at the beginning of QE (quantative easing) despite the BOE having bought £200bn of bonds. A simply staggering amount.

I think it says it all about Brown’s economic mismanagement that he has had to resort to printing money via QE to cover the budget deficit. If that is not naked politicking, putting party before country, I don’t know what is.

“I think it says it all about Brown’s economic mismanagement that he has had to resort to printing money via QE to cover the budget deficit.”

The intended purpose of QE – and the decisions about magnitude and timing are made by the Bank of England’s Monetary Policy Committee – was to prompt the UK banks into increasing their business lending. The notion of QE does not appear heterodox to those – like myself – who follow keynesian policy traditions. When bank rate has been cut to 0.5%, the only remaining means for further monetary policy stimulus is through QE. The latest assessment of the BoE in December is that the banking system is stabilizing.

Explicitly or implicitly it’s widely agreed that public spending will need to be cut back. What matters for the immediate future is the timing of spending cuts as most informed commenators acknowldge a persisting current risk of a double-dip recession or even worse, such as a bout of deflation with a fall in the general price level, which leads businesses and consumers to postpone spending thereby causing a recession to deepen.

What worried me prior to the development of the financial crisis in 2007/8 was that warnings about the systemic risks to the financial system from derivatives and hedge funds were ignored, as were warnings about the house-price bubble. But who among the Conservatives was then urging greater regulation of the financial system to better control derivatives trading or rein back the boom in consumer borrowing? If Brown was at fault then so was the Conservative frontbench.

Even before the crisis of 2007/8, there was ample evidence of waste in public spending. I find this recent example astonishing:

“The National Health Service can make the £15bn to £20bn of savings needed during the next three years without damaging the quantity or quality of care – indeed while even improving the latter – according to David Nicholson, the NHS chief executive.”

http://www.ft.com/cms/s/0/6fba7dfe-e683-11de-98b1-00144feab49a.html

The present NHS budget is c. £104 billion. How come as much as £15bn to £20bn can be saved without damaging the quantity or quality of services – according to the NHS chief executive? That really doesn’t say anything reassuring about productivity in the NHS. The big question is how far much of the same can be said of other public spending?

What Conservatives and the champions of Free Markets are failing to focus on is this: How Markets Fail (Penguin Books, 2009), a new book by John Cassidy which documents failures in the American financial system and which is attracting glowing reviews in unexpected places:

http://www.businessweek.com/magazine/content/09_47/b4156079791251.htm

As you say, that was the stated intention of QE. It has however spectacularly failed to work in the desired manner – Gilt yields are higher, business lending is still extremely low and mortgage rates have barely moved.

The reason is that buying Gilts from the market simply doesn’t free up bank’s capital (Gilts are Tier 1) in the same way as buying mortgage backed securites or corporate debt from them does. The US QE program almost exclusively buys lower tier paper. The UK system really only really serves to fund the governments’ deficits.

On your point about hedge funds; they haven’t contributed to this crisis. IN fact they have probably played an important role in lessening its effects by providing liquidity. They have proved a useful place for banks to sell some of the distressed assets to, thus freeing up balance sheets. Some larger firms have even been lending directly to banks in a quaint role reversal.

The financial crisis was, in the main part, by too much leverage. Not only on the part of banks, or overspending by governments, but also driven by the end user – you and I. Mostly through mortgages, driven by low interest rates and a house price bubble. (and yes, mortgages are highly leveraged instruments). Subprime loans and CDOs definately played their part, but it was a general overextension of the financial system, at a number of levels which really tipped the boat.

On Keynes;

His work was on a *closed* system (which our economy is not – capital flight) and his basis for recessionary spending incuded saving during periods of growth. It DIDN’T involve incurring huge debts and stifling future growth on that basis. I really hate it when Labour and Brown spin that line, using Keynes in error, as justification for what really boils down to incompetent financial management.

You can see it again and again around the world – Keynsian stimulus just simply doesn’t work when it drives a country into massive deficits and debt. Japan is a fine example. They tried it in the 80′s, rolled up huge debts and have had sub-par growth ever since.

Simply put, massive deficits and large debt overhangs squash growth. Keynsian spending might delay the day of reckoning but it can’t escape the fact that debts will have to be repaid with interest, meaning higher taxes and reduced growth further down the line.

Why can’t people see that?

Reportedly business lending by banks is improving but banks in Britain evidently used recepits from gilt purchases under QE to rebuild reserves without increasing business lending until, perhaps, lately. My guess is that what inhibits QE purchases of second order financial assets is a BoE headache over what to dare to buy because it goesso much against the tradional grain here. Interestingly, I believe that in Japan the equivalent of QE has been used there to buy into corporate equity and that’s not regarded as outrageous there.

I remain sceptical about the contribution of hedge funds because of fat tails in risk distributions. Anything enabling the continuing circulation of CDOs (collateralised debt obligations), underpinned by duff subprimes, ultimately damages credibility and trust in financial markets. It was loss of that trust which stymied the interbank borrowing in wholesale money markets that had kept NR, RBS and HBOS going.

I certainly agree about overleveraging in the financial system and it will take new (international) regulations to require banks to maintain larger capital reserves. The interesting and challenging issue is whether counter-cyclical variation of bank capital requirements will be accepted here – because that would require discretionary intervention. Lord Turner’s reviews of FSA regulation mentions somewhere that counter-cyclical variation of bank capital requirements was introduced in Spain although that didn’t stop a property-price bubble developing there.

Btw we need to look too at the implications of China’s and Japan’s continuing huge balance of payments surpluses and what China does to keep the exchange rates of the Renminbi and Yen depressed.

Granted that Keynes’s macroeconomics c. 1936 was built on the assumption of a closed economy. But, heavens above, the previaling orthodoxy at the time was denying the possibility of persisting unemployment, saying it was all a temporary aberration – despite the manifest facts – and unemployment could be resolved by general wage cuts.

Economics after Keynes + Tinbergen + Kalecki became very different although controversy continued over interpretations of the General Theory and Keynes tended to a (regretable) habit of endorsing sympathetic interpretations despite mutual conflicts. Other economists – notably Nobel laureate James Meade – extended the keynesian framework to an international dimension. Mankiw at Harvard (very sensibly IMO) refuses to engage in arguments over textual exegesis because it is ultimately unproductive. The important development in theoretical perspective is to look at what is happening – or would happen – to aggregate demand consequent upon policy changes – or events. Many folks haven’t got that far.

The clever policy step in Britain in September 1931 in the depression was to take the Pound off the Gold Standard – perpetrating a great heresy. The Pound depreciated in the foreign exchange markets and the (then independent) Bank of England could cut interest rates once relieved of the legal obligation to defend the Gold value of the Pound. In due course, a property boom developed on the basis of low interest rates.

Think about this:

“Last week, Roger Bootle, managing director of Capital Economics, forecast that bank rate would not exceed 1 per cent in the next five years.”

http://www.ft.com/cms/s/2/240680c0-eb28-11de-bc99-00144feab49a.html

“Why can’t people see that?”

Most do in spite of the political rhetoric. The substantive issues are between tax increases v spending cuts and when and how spending cuts are to come if a double-dip recession is to be avoided.

The IFS is a far better guide to the realities than the political blame game. The facts are that in 2007 Britain was neither a heavily taxed nor a high public spending economy by comparison with most other west European coutries. The fiscal boost in Darling’s PBR was modest in comparison with most other G7 economies.

Granted that Britain’s public finances were not on a sustainable basis pre-crisis but there wasn’t a simple option of just toughening the fiscal stance (raising taxes or cutting spending) because the Bank of England would then have had to cut interest rates – to keep to its inflation target – and lower interest rates would have boosted consumer borrowing and the house-price bubble, unless the banks had been required to increase their reserve requirements!

Tier 1 capital such as Gilts *are* banks reserves. As such, the BOE buying them has little effect on a banks ability to lend. Taking lower tier capital from banks would have enabled them to lend more, as less would have to be held in reserve against it. Simples. As such, it does beg the question why UK QE is not more like the US version…unless of course it was designed not so much as to free lending as to finance a deficit.

Hedge funds have little or nothing to do with CDOs/subprime. That was banks repackaging mortgages into more saleable, investable chunks (which in turn, brings borrowing costs down). In itself, even CDOs are beneficial to the end users (i.e. you and I, when we try to get mortgages) except when you have black swan events like this crisis, and the failure rate of mortgages is much higher than was modelled. Then you have big trouble….the failure of CDOs is really of th emodels behind them, not so much the idea of the CDO itself.

Britain was *forced* off the gold standard in 1931, for the second time (previously in 1914). It wasn’t a policy step, as you call it.

Britiain’s marginal tax rate is quite high – in 2007 we passed Germany on that front. Our public spending is also very high – 13% deficit anyone? Even as a % of GDP it is well up there, and is significantly higher once PFI is taken into account (which again, the government does not do).

The house price bubble was not controlled, as house prices are not in the BOEs inflation target. A certain Mr Brown set that target. Wether through incompetance or deliberate planning, racing house prices caused a massive problem in the UK, and huge windfalls in tax reciepts for the treasury.

Talk about avoiding a double dip recession is nonsense. Saddling the economy with huge debt burdens consigns it to sub-par growth in the future, and makes a future recession more likely and more painful. Wayward deficit spending is clearly not in the countries best interests, though Labour clearly aren’t thinking like that. They are trapped by their own misadministration, and are thinking only about the next election. We may get back into growth territory, but the forcasts in the PBR are fanciful at best.

By 2015, under Labours plans laid out in the PBR, debt maintenance will cost £80-85bn, up from £35bn now (though they use a low forcast for rates). To put that into context, that is roughly equal to the education budget, and almost as much as is spent on the NHS.

The economy is not going to grow the 20% needed to balance the books, so most of the deficit is going to have to be covered by taxes and cuts. LIke it or not. Taxes stifle growth. This, of course, is just to *balance* the books.

Price of failure anyone?

The effect on the lending ability of banks from QE purchases of Gilts presumably depended on who exactly was selling the Gilts. Besides that, another effect of QE was to boost Gilt prices and thereby reduce government borrowing costs.

“except when you have black swan events”

The 2007/8 financial crisis is a hugely magnified re-run on a wider and greater scale of the Saving & Loan Association crisis in America in the 1980s and 1990s:

“The savings and loan crisis of the 1980s and 1990s (commonly referred to as the S&L crisis) was the failure of 747 savings and loan associations (S&Ls) in the United States. The ultimate cost of the crisis is estimated to have totaled around $160.1 billion, about $124.6 billion of which was directly paid for by the U.S. government—that is, the U.S. taxpayer”

http://en.wikipedia.org/wiki/Savings_and_Loan_crisis

American regulatory authorities evidently learned absolutely nothing from that debacle – even though I first learned about it from a well-reviewed, regular economics text: Donald Campbell: Incentives (Cambridge UP 1995, 2006).

“Britain was *forced* off the gold standard in 1931, for the second time (previously in 1914). It wasn’t a policy step, as you call it.”

C’mon. Ramsay Macdonald’s Labour government (1929-31) maintained the Gold Standard while its successor, the National Government, abandoned it. Snowden, the Labour Chancellor, was quoted as saying: No one told us we could do that.

The Nazi Third Reich government in Germany maintained the Gold value of the Reich Mark with a host of exchange controls and import restrictions. Britain could have resorted to similar methods but (sensibly) chose not to. But the keynesian-type public spending policies of the Nazi government were hugely successful in bringing down unemployment in Germany ” . . from 6 million in October 1933 to 4.1 million a year later, 2.8 million in February 1935, 2.5 million in February 1936, and 1.2 million in February 1937.”

[CP Kindleberger: The World in Depression 1929-1939 (Allen Lane, 1973) p.240]

Keynes visited germany to lecture in January 1932 – a year before Hitler became Reich Chancellor – and wrote an article for the New Statesman on his return: “Germany today is in the grips of the most powerful deflation any nation has experienced . . ” [DE Moggridge: Maynard Keynes (1992) p.539]

“The house price bubble was not controlled, as house prices are not in the BOEs inflation target.”

No, but Gordon Brown chose to redefine the BoE’s inflation target in February 2004 from 2.5%, in terms of the old RPIX, to 2% in terms of the CPI, a more narrowly based price index and one that doesn’t include housing costs, unlike the former. The two price indices have diverged, which means the BoE’s MPC would have been making very different decisions about interest rates had the old target been retained.

http://www.statistics.gov.uk/cci/nugget.asp?ID=19

Charles Goodhart, amongst others, argues that the BoE’s inflation target should include house prices. The US Fed’s statutory remit is less specific than the BoE’s remit and the US Fed retained a discretion to intervene to curb growth of asset-price bubbles but elected not to do so. There is an unresolved controversy among policy theorists and makers about whether inflation targeting by central banks should include remits to curb asset-price bubbles. Of course, there is inevtiably an issue about how to diagnose the development of asset-price bubbles when these arise.

quoting Greenspan, Bob B, is not very good. it looks higly likely at this point in time that his policies at the Fed exacerbated our woes now.

And blaming banking collapses on the policies of the Opposition is not a very clever move either.

And saying that banking collapses for different reasons happened in the USA is not very clever either.

And how would you exonerate UK local council treasurers placing money on deposit in Icelandic banks because there was nothing in FSA ratings that said those banks were risky when many people (including journalists) around the world were wondering when, not if, the Icelandic economy would collapse?

Sorry, Bob…it is about time your mate Gordon should face up to the fact that he called so many things wrong….

“Sorry, Bob…it is about time your mate Gordon should face up to the fact that he called so many things wrong….”

As posted before, I didn’t vote in the last general election in 2005 and I probably won’t vote in the next either. I’m the typical floating voter – at various elections I’ve voted Conservative, Labour, Liberal and Social Democrat, depending on the prevailing circumstnces at the time. At the last election, more of the electorate didn’t vote than the numbers who voted for Labour candidates. I considered – and still consider – Blair a charlatan.

As my posts above might suggest, I regard the political blame game as silly, not least because it inhibits rigorous analysis of events and diagnosis of policy failures.

Alan Greespan has admitted some blame for the financial crisis because he believed that banks could be depended to act to safeguard the interests of their own shareholders and they manifestly didn’t do so. A policy regime in which bankers privatise profits from their trades and deals while taxpayers are expected to pay for losses is bound to lead to a crisis.

There’s widespread agreement here and among other G7 countries about the need for a new regulatory regime for banks – which is why so many governments have been calling for restrictions on the bonuses paid to bankers which motivated reckless trading.

“The leaders of France and Germany have swung behind the idea after the UK announced a one-off supertax on banker bonuses in a pre-Budget report.”

http://news.bbc.co.uk/1/hi/world/europe/8405214.stm

Evidently, the smarter banks have got the message:

“Goldman Sachs’ top executives will forgo cash bonuses this year as the Wall Street bank reacts to intense pressure over its pay policy in the months after it received a $10 billion taxpayer bailout.

“Lloyd Blankfein, chief executive, and the 29 other members of its management committee will receive their share of the estimated $22 billion bonus pool in Goldman shares, which cannot be sold for five years.”

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article6952300.ece

For a heavyweight diagnosis of the crisis, try this recent piece by Noble laureate Joe Stiglitz:

http://www.guardian.co.uk/commentisfree/2009/dec/13/mervyn-king-banks-curbed

“Absolutely. It’s not very democratic. It’s not Cameron’s ‘good, clean fight’. ”

I fail to see what is not democratic about it. The Credit Rating Agencies apply a ruler to British policy and come up with a rating. They do not do that capriciously. They follow what the British Government does precisely. If the Labour Government ran economically sensible policies they would upgrade their ratings. It has chosen not to. If Gordon Brown leapt out of a window in the Gherkin, gravity would not be to blame for him splattering across the pavement. Nor would be any analyst who saw him and pointed out that he was about to splatter. The blame would lie with Brown. As with Britain’s credit rating.

Re: the above

Totally agree….ratings agencies are entirely reactionary and backward looking – things have to have met certain criteria for a downgrade etc. They don’t change ratings unless there is *observable* reason for doing so.

Reactions: Twitter, blogs

-

Liberal Conspiracy

:: Tory strategy: to hope for a credit downgrade http://bit.ly/87a6rz

-

Andrew Roche

Tory strategy: to hope for a credit downgrade http://ff.im/-dzpVd

-

Rob Watson

http://bit.ly/7MrknU Tories talk-down UK economy. (via @rmlabour)

Sorry, the comment form is closed at this time.

NEWS ARTICLES ARCHIVE