How right-wing economics has trouble standing up

11:46 am - January 4th 2010

| Tweet | Share on Tumblr |

When it comes to the economy, right-wingers have one simple narratives: to reduce the size of government so it can aid job creation and growth in the economy.

That is, after all, what Milton Friedman advocated. The theory goes that government spending crowds out more efficient private spending – and therefore job creation – and the economy suffers.

But the evidence fails to support that, when applied to Capitalism’s natural home: the United States of America.

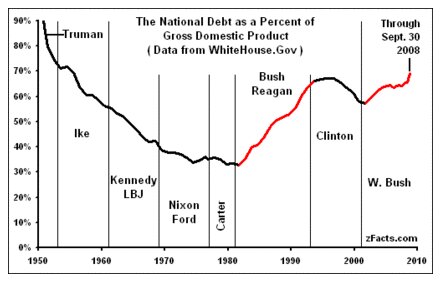

First, right-wingers frequently say they are committed to reducing the deficit and size of the government. But as the graph below shows: Republicans have actually presided over a growth in US national (and world debt) more than Democrats.

via Think Progress

But what about policies? Perhaps the tax-cutting policies of Ronald Reagan (during the 80s) and George Bush (during the 00s) stimulated the private sector and job growth?

Nope. As the graph below shows, job creation was markedly lower during both those periods. It was massive during the highly interventionist New Deal era.

Both the Reagan and Bush era show terrible progress. In fact, the Bush era was the first in history where job creation was at Net Zero, as the Washington Post pointed out this weekend.

Some may say: well, because Reagan and Bush didn’t reduce the deficit, as shown in graph 1, they managed terrible job creation.

Not necessarily. Both cut taxes for corporations and rich people massively, in the belief that stimulates job creation.

Both also claimed to cut regulation for businesses in the hope it stimulated jobs. All it created were bubbles that were built on sand left the poorest worse off.

Not only does the right-wing economic evidence fail to stack up, but the first graph shows that Republicans say one thing while doing another.

| Tweet | Share on Tumblr |  |

Sunny Hundal is editor of LC. Also: on Twitter, at Pickled Politics and Guardian CIF.

· Other posts by Sunny Hundal

Story Filed Under: Blog ,Economy ,Foreign affairs

Sorry, the comment form is closed at this time.

Reader comments

Yes. Well. Picking a decade at the end of the Great Depression is, obviously, going to show a lot of economic growth. What is more that graph does not show the New Deal at all – the period 1933 to 1936 – but the effect of World War Two. Which did cause a lot of economic growth. In the United States. I don’t see how the New Deal can get the credit for that. Indeed if the starting point in 1940 was not so low, the end point in 1949 would not look so high. A twenty five year period 1925 to 1949 would show a different picture.

Also picking the year 2009 without pointing out the unusual circumstances of that year is a mistake as well. That does not reflect on Bush Junior’s record per se but on the cyclical downturn in the economy brought on by decades of bad lending. A more interesting comparison is Reagan. Who did not trim the deficit but on the other hand, his structural changes brought about a period of low economic growth but set the stage for the decade or more of growth that followed. Like Blair, Clinton simply continued the Right’s economic policies.

You’re forgetting the 1920-1921 depression (http://en.wikipedia.org/wiki/Depression_of_1920–21) where unemployment dropped from 11.7m in 1921 to 6.7m in 1922 while government spending dropped by over a quarter (http://www.cato.org/pubs/journal/cj16n2-2.html)…

Left-wing US economics blog Angry Bear has run a series of post showing how the US economy has performed under GOP and Dem administrations … here is the latest.

To play devil’s advocate: if the Dems tend to reduce the deficit and the economy tends to do better under Dems, does that mean that right wingers are correct to say shrinking the government helps the economy? I don’t think you can have it both ways… if Republicans do not practice what they preach then you cannot use what happens under Republican administrations to evaluate the merits of what they preach.

Another popular economic right wing fallacy is to think of the private sector as “funding” the public sector, so that the larger the public sector gets, the harder the private sector has to work to fund the public, and that only the private sector creates wealth while the public sector just spends it. I tried to take on this argument in the comments of this post.

Milton did indeed believe that the best thing the government could do, in most cases, was get out of the way, and in some settings he was right. I think he underestimated how the public sector is actually better at doing many things than the private sector, and also how some of these public sector services actually complement private sector production instead of substituting for it.

The Saving & Loan Association crisis in America during the 1980s and 1990s was a major contributing factor to the fiscal deficits of the Reagan and Bush (Snr) presidencies:

“The savings and loan crisis of the 1980s and 1990s (commonly referred to as the S&L crisis) was the failure of 747 savings and loan associations (S&Ls) in the United States. The ultimate cost of the crisis is estimated to have totaled around $160.1 billion, about $124.6 billion of which was directly paid for by the U.S. government—that is, the U.S. taxpayer”

http://en.wikipedia.org/wiki/Savings_and_Loan_crisis

Sadly, the US regulatory authorities in the Bush (Jnr) administration seem to have learned nothing from that previous solvency crisis among US financial institutions. This time round, Alan Greenspan, in his testimony on 24 October 2008 to the US House of Representatives Oversight Committee, blamed bankers for failing to safeguard the interests of their shareholders:

“Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief.”

http://online.wsj.com/article/SB122476545437862295.html

Tom Frank argues that deficit raising is not a failure but an explicit republican strategy.

Firstly, it usually comes from a tax cut for the very wealthy (who fund the party and its wingnut think tanks). Once run up, means the left have a hard job in office because they find there isn’t the money for progressive programs, which makes them both look like people who don’t achieve, and more strategically, makes progressive government look like a chimera. The latter feeds the notion that the state can’t work, and that limited government is both desirable and also the only workable aim.

The final benefit to them is that deficit means spending cuts, which mean the public sector workforce who are a large part of the democratic base are hit, impacting on prgressive candidates’ ability to fundraise. Job’s a good ‘un.

I don’t think you can say this is “right-wing economics”, as if right-wing = small government. A casual glance at history shows it isn’t so.

A more fitting scale I think would be-

Left: Socialism/Communism – Social Democracy – Liberalism – Protectionism – Fascism/Corporatism: Right

Economic liberalism has been supported at times by socialists, Tories, labour movements, and all sorts. It’s centrist if anything.

P.J. O’Rourke: “The Republicans are the party that says government doesn’t work and then they get elected and prove it.”

As it happens, Bill Clinton was a much much better fiscal conservative than George Bush. But you also need to factor in that this far from being only about the president. I think divided governnent’s (mix of Democrats and Republicans in congress and presidential levels) tends to slow spending down. Give the keys to either party without other to counter-balance and that is when things really start to go crazy.

“but the first graph shows that Republicans say one thing while doing another.”

Well of course, they’re politicians after all.

“Yes. Well. Picking a decade at the end of the Great Depression is, obviously, going to show a lot of economic growth.”

Quite.

But vastly more amusingly, let’s look at the same information that Sunny’s given us again (without any appeals to any outside information at all).

From the second graph we see that peacetime economic growth was highest in the 50s and 60s.

OK.

From the first graph we see that reductions in the stock of government debt were highest in the 50s and 60s.

So we have a nice little correlation between a reduction in government debt and an increase in the GDP growth rate.

But wait! Correlation may imply causation but it doesn’t prove it. Could there be causation here?

“That is, after all, what Milton Friedman advocated. The theory goes that government spending crowds out more efficient private spending – and therefore job creation – and the economy suffers.”

Ah, no, that’s not the theory. Government *borrowing* crowds out private sector borrowing. Reducing private sector investment and thus reducing the rate of growth of jobs and GDP. That’s the theory.

And as we see government borrowing falling as a percentage of the economy (the stock of it, of course, not the annual additions or deductions from that stock) we also see GDP growing.

And just as a second test, when we see the stock of debt declining in the 90s we also see an uptick in GDP growth. As a third we also see that when government debt is rising then growth rates fall.

“But the evidence fails to support that”

Thus the evidence does indeed support what Uncle Milt was saying. Reduce government borrowing and the economy will grow faster. Exactly as it did in the 50s and 60s.

Thanks for putting those graphs up Sunny. I’ve never seen the evidence for the point so clearly laid out.

The biggest single reason WHY the Republicans tend to let the budget deficit balloon is so that there will be a strong argument for reducing the size of the state sector. The pattern is basically: Spend on the military etc., cut taxes, grow the deficit, and then wring your hands and say “Look, the deficit is so big, we HAVE to cut social security / medicare / whatever, now!”

@8 Tim – that did make me chuckle, thanks. Almost sounded too easy for you.

I think Paul Krugman said it best in his book <the return to depression era economics. Talking about the multiple currency devaluations and bank runs that have occurred since the mad rush to re-embrace market fundamentalism (ie. since Reagan / Thatch):

“We – by which I mean not only economists but also policymakers and the educated public at large – weren’t ready for this. The specific set of foolish ideas that has laid claim to the name “supply side economics” is a crank doctrine that would have little influence if it did not appeal to the prejudices of editors and wealthy men. But over the past few decades there has been a steady drift in emphasis in economic thinking away from the demand side to the supply side of the economy”

Supply side economics is a crank doctrine! Quite!

@Luis: “…if Republicans do not practice what they preach then you cannot use what happens under Republican administrations to evaluate the merits of what they preach”.

An odd attitude to take, I reckon. Surely, if the Republicans constantly preach fiscal sanity and but repeatedly empty the federal Treasury into the pockets of their backers and America’s economic royalty, this tells us that “What they preach” is really just bullshit designed to facilitate economic royalism.

And Tim’s airy “They do this stuff because they’re politicians” doesn’t really cut it. We’re talking about the planet’s leading proponents of right wing economics – if a system presided over by the Randroid Rambo Alan Greenspan serially enriches a tiny elite and blows up the world every five years, then this most certainly tells us something about the efficacy of of this form of economics.

Or who knows? Maybe it just tells us that politicians are bastards and that we all need to clap harder for deregulation. There’s a sucker born every minute, after all.

F.R.

What they preach might well be designed to facilitate their tax give away … I just mean that if I preach A but practice B, you can’t learn about A

@11: “Supply side economics is a crank doctrine! Quite!”

I don’t agree and regard myself as following keynesian traditions.

It is often overlooked that Keynes in his seminal book: The General Theory . . (1936) postulated both an aggregate supply function as well as an aggregate demand function as part of his theory.

http://homepage.newschool.edu/het//texts/keynes/gtcont.htm

I think part of the problem derives from JR Hicks’s interpretation of the General Theory in his seminal paper of 1937 on keynes and the Classics, which was a huge influence on later postwar textbook presentations of macroeconomics. Keynes endorsed the paper on publication but Hicks himself later downplayed its value because it amounted to a static analysis of macroeoconomic equilibrium whereas the GT was full of analytical discussion of what happened to an economy through time in response to, say, cuts in business investment and the casino economics of stock markets:

http://www.eco.utexas.edu/Homepages/Faculty/Cleaver/368hicksonkeynes.html

I can’t see how the downstream consequences cost-push inflation can be analysed except in terms of an aggregate supply function. Both Kalecki and Abba Lerner, writing in a keynesian tradition after the GT, focused on the consequences of powerful trade unions, with monopoly power in labour markets, pushing up wage rates. There is also the case of analysing the consequences of hikes in world oil prices since the demand for oil is price inelastic in affluent countries, at least in the short run.

F.R.

What they preach might well be designed to facilitate their tax give away … I just mean that if I preach A but practice B, what happens to me won’t tell you whether A is a good idea or not.

Some other ways of looking at it;

Total Additional Outlays per

Presidential Term (billions of constant dollars)

Johnson $223

Nixon $44

Carter $179

Reagan I $176

Reagan II $103

G.H.W. Bush $117

Clinton I $68

Clinton II $136

G.W. Bush I $345

G.W. Bush II $287

So – discretionary public spending tends to go up when Republicans are in the White House. But it goes down when Republicans control Congress.

The biggest spenders – irrespective of party – are Texan presidents.

Caveat: Reagan’s extra spending was a mostly a massive arms build-up – calculated to bankrupt the Soviet Union and end the Cold War…. therefore not typical.

(figs from here: http://www.thefreelibrary.com/)

…..oops, that should be

“discretionary public spending tends to grow faster when Republicans are in the White House. But the rate of growth is slower when Republicans control Congress.”

Ahhh, I was waiting for the right-wingers to turn up and try and make some technical points to undermine what is so obvious there.

Anyway.

I don’t see how the New Deal can get the credit for that.

The impact of the New Deal wasn’t entirely immediate, that’s why.

That does not reflect on Bush Junior’s record per se but on the cyclical downturn in the economy brought on by decades of bad lending

The cyclical downturn wasn’t necessarily cyclical – it came about as a direct result of getting rid of regulation, which allowed unchecked speculation and investment in areas that didn’t actually do any sustainable job / wealth creation.

Luis: if the Dems tend to reduce the deficit and the economy tends to do better under Dems, does that mean that right wingers are correct to say shrinking the government helps the economy?

I addressed that point at the end. Dems don’t work by the right-rule book because the reduce the deficit by increasing taxes (which doesn’t lead to job destruction) and by increasing spending on social programmes (which increases spending and therefore creates jobs).

Tim W: So we have a nice little correlation between a reduction in government debt and an increase in the GDP growth rate.

I addressed that point at the end, if you bothered to read. It doesn’t necessarily lead to causation.

Thus the evidence does indeed support what Uncle Milt was saying. Reduce government borrowing and the economy will grow faster. Exactly as it did in the 50s and 60s.

the economy did grow faster – but the Democrats managed to reduce govt debt (wasn’t difficult given increasing tax revenues) while at the same time massively expanding spending on social programmes to help the poor.

That also led to a massive increase in job creation.

It’s when you get to Reagan – who talked Milton Friedman but failed to carry out manage to create jobs, while at the same time cut taxes and regulation (which also failed to create jobs) – that you see how rubbish the whole theory is.

To be clear – I’m not against reducing govt deficit. The graph shows how hypocritical Republicans are in their noise about debt.

What I’m pointing out is that cutting taxes, reducing regulation and talking up monetarism seems to have had little impact on job creation.

“The impact of the New Deal wasn’t entirely immediate, that’s why.”

That’s partly because President Roosevelt really believed in balanced budgets, which is why the US economy turned down after 1937 when the administration tried to balance the budget. Roosevelt didn’t understand what Keynes was on about and only a few American economists at the time did.

Supplying arms to Britain funded through lend lease, rearmament and WW2 then boosted the US economy through to full employment.

I was about to post a long rebuttal to most of the complete ar$e that Sunny has talked about above, but I won’t. I’ll make a few simple points instead.

1. The most recent period of significant financial deregulation was under Clinton.

2. Bush Junior was not the chap who created legislation which created this recession. Subprime/Alt A market was created by the 1993 communities reinvestment act (Clinton)- see point 1 above.

3. Reagan’s deficit increase was hugely affected by the Savings and Loans crisis.

4. More spending -> job creation might be true, but not private sector (i.e. tax contributing) jobs. Lower taxes was probably the biggest driver of job creation under Clinton, for example.

5. Larger deficit spending always subdues long term growth, though in the very short term might conceal weakness in an economy. Larger deficit = more tax but also crowds out other debt, forcing industry to pay higher costs on their own borrowing.

sorry, I made some very basic mistakes – confusing the annual fiscal deficit with the stock of public debt and then confusing either of these with the size of the government. What I should have asked is that if the size of the government actually tended to expand faster under Republicans, and the economy tends to do worse under Republicans, then does this mean they are actually right to preach expanding govt is bad for econ? What I need is data on govt size as % of GDP under Repub and Dem – it is possible that Dems reduced debt at same time as expending govt.

It seems that Sunny’s post is saying that reducing the deficit is a good thing for economic growth (that’s what the two graphs suggest), but that Republicans tend not to actually reduce the deficit, despite talking about it a lot. If Republicans were as good at reducing the deficit as they were at talking about it, they’d have been a lot more successful.

There is a worthwhile point here: people who talk loudly about fiscal responsibility might just be those with the most to hide. If you need to convince people by telling them you’re being responsible, rather than proving it by your actions, maybe you’re deluded or malicious.

I don’t think that this is limited to politicians of the Right though.

Tim Worstall

‘ From the first graph we see that reductions in the stock of government debt were highest in the 50s and 60s.

So we have a nice little correlation between a reduction in government debt and an increase in the GDP growth rate.

But wait! Correlation may imply causation but it doesn’t prove it. Could there be causation here? ‘

National debt is always expressed as a ratio of GDP. Gross debt can be increasing the stock of debt simultaneously with the ratio falling. It is usually GDP growth that is causing the ratio to decline rather than net repayment of government debt. You can’t deduce from the graph that the stock of government debt was ‘ reducing in the 50s and 60s ‘. What one can deduce is that GDP growth was higher preventing the need for the government to run a deficit.

“That is, after all, what Milton Friedman advocated. The theory goes that government spending crowds out more efficient private spending – and therefore job creation – and the economy suffers.”

‘Ah, no, that’s not the theory. Government *borrowing* crowds out private sector borrowing. Reducing private sector investment and thus reducing the rate of growth of jobs and GDP. That’s the theory.’

Although government borrowing does raise long-term interest rates. On the flip side government borrowing also reduces the effective exchange rate and thereby boosting net exports. The relevant issue is not government borrowing per se, but what are they spending the borrowing on.

‘ And as we see government borrowing falling as a percentage of the economy (the stock of it, of course, not the annual additions or deductions from that stock) we also see GDP growing.

And just as a second test, when we see the stock of debt declining in the 90s we also see an uptick in GDP growth. As a third we also see that when government debt is rising then growth rates fall. ‘

As previously stated one can’t make the assumptions that you are making from the graph. The graph only indicates that the ratio was falling as GDP growth advanced. There may well have been net repayment of debt in the 50s/60s/ 90s but that is not in the graph. Under Reagan and G.W. Bush one can deduce that with GDP growth they still increased the stock of debt. That led Dick Cheney to say a couple of years ago that ‘ Reagan taught us that deficits do not matter ‘ . He could have added that all changes when a Democrat is in the White House and we become hysterical about the deficit.

‘ Thus the evidence does indeed support what Uncle Milt was saying. Reduce government borrowing and the economy will grow faster. Exactly as it did in the 50s and 60s. ‘

Or ensure the economy is in a position to grow and the need for government borrowing will decline.

‘ Thanks for putting those graphs up Sunny. I’ve never seen the evidence for the point so clearly laid out. ‘

“You can’t deduce from the graph that the stock of government debt was ‘ reducing in the 50s and 60s ‘.”

I can indeed deduce that the stock of government debt as a percentage of the economy was reducing in the 50s and 60s. For what the graph shows is the stock of government debt as a percentage of the economy. And it’s declining in the 50s and 60s.

And for the crowding out argument, what are we concerned with? The size of the stock of government debt as a percentage of the economy of course.

For we don’t really care about a $10 billion stock of debt in a $1 trillion economy. But we most certainly do care about a $10 billion debt in a $5 billion economy.

24. Tim Worstall

I do not disagree with that. However, I read you as implying that there was net repayment of debt in the 50s and 60s and this caused GDP growth. There may well have been but that is not in the graph. The ratio declined but that is not the same as the stock being reduced.

“Capitalism’s natural home: the United States of America.”

AHAHAHAHAHAHAHA.

Fucking good one that old chap.

“There may well have been but that is not in the graph.”

Indeed, but if we go to Wikipedia

http://en.wikipedia.org/wiki/United_States_public_debt

We see that the gross debt (measured in constant dollars) did decline over the same time period.

1. The most recent period of significant financial deregulation was under Clinton.

But its impact was mostly apparent afterwards. Make no mistake – I think Clinton made a mistake. But the right weren’t exactly saying that at the time.

3. Reagan’s deficit increase was hugely affected by the Savings and Loans crisis.

So? The Republicans are still talking about the size of debt now aren’ they even though their man bailed out the banks and helped push deficits through the roof?

Lower taxes was probably the biggest driver of job creation under Clinton, for example.

So why didn’t this apply to Reagan and Bush, who cut taxes even more aggressively?

Rob Knight – you got it spot on. I’m not against fiscal responsibility. But I do think its important to keep spending during recession times and decrease during boom times to balance the budget. The Tories are not advocating that. And Republicans talk rubbish when they say they’re fiscally responsible.

And lastly – tax cuts don’t seem to lead to massive job creation.

“decrease during boom times to balance the budget.”

And there is the biggest problem with Keynesian economics. Forget all about whether it works or not and think about the political implications of that phrase in quotes.

Do you remember what did happen back when the coffers were full? You had Polly and every other special interest in the country screaming that “look! look! lots of money!” so let’s go and spend it on my/our pet project.

Which is why of course we didn’t pay down our debt at the tail end of the longest boom in modern times.

Note of course, it’s not “to balance the budget”. It’s to have a budget surplus and pay off some of the debt run up in hte bad times. And if you really want to be Keynesian about it, a budget surplus so as to provide fiscal contraction and stop the boom getting out of hand.

Now imgine there’s a boom before an election. Tax revenues are soaring. So, the proper Keynesian thing to do here is either to raise taxes even more or to slash spending, so as to have a fiscal contraction.

Can you imagine, in your wildest dreams, a politician doing that with an election around the corner?

No?

Then we can’t really partake of Keynesian demand management then, can we?

Of course tory plans don’t not add up.

They are going to cut taxes for the rich middle class. They are going to spend more on defence and health. And they are going to cut the deficit. Can’t be done.

Unless……..

You make huge cuts in spending, and I am not talking about that old chestnut of eliminating waste. I mean real big spending cuts on welfare and other govt departments. Which of course is what they are secretly planning. But since call me Dave has told us he is in favour of open govt, perhaps he should tell the British people exactly where these cuts are going to fall.

20. Daniel

‘ Bush Junior was not the chap who created legislation which created this recession. Subprime/Alt A market was created by the 1993 communities reinvestment act (Clinton)- see point 1 above. ‘

The idea that poor people are to blame for the financial crisis has been refuted many times. The Communities Reinvestment Act was passed 1977, yet, it was not until 2002 when there was an explosion of lax lending leading to underwater loans 2007. Nothing in the Act compelled lenders to reduce their lending standards.

http://www.jchs.harvard.edu/publications/governmentprograms/n08-2_park.pdf

The majority of defaulted loans were made by institutions not covered by the CRA.

http://www.federalreserve.gov/newsevents/speech/kroszner20081203a.htm#f6

The Gramm-Leach-Bliley Act, three Republicans was much more relevant than the CRA.

http://en.wikipedia.org/wiki/Gramm-Leach-Bliley_Act

Lax lending standards to the commercial real estate sector in the US is as much a factor in the financial crisis as subprime. That type of lending certainly was not to the poor.

A number of thoughts are inspired by this article. For example:

1. A while ago, there was a discussion on LC about the misleading use of statistics by an Amnesty UK campaign. The writer of the above article was one of those happy with Amnesty’s behaviour, because it was done in support of a campaign he also supported.

So I no longer believe anything he tells me. After all, he told me that he was in favour of misleading people in support of his favourite causes.

2. He claims to be interested in testing the theory that “government spending crowds out more efficient private spending – and therefore job creation – and the economy suffers.” To test this theory, you need circumstances in which government spending has varied widely, without much else changing, which means you should look for otherwise-similar countries with wildly different levels of government spending, or a single country in which the level of government spending in similar circumstances has varied widely.

If the US is “Capitalism’s natural home”, a country in which government spending is almost always rather low, it is a terrible test case for the theory.

3. If he is interested in testing whether high government spending is a problem, he should pay at least some attention to The Level Of Government Spending. None of the data given was on the level of government spending, either in an absolute measurement, or as a fraction of GDP, or in any other sense.

4. When he claimed to be supplying evidence to test the theory he was either dishonest or self-delusional.

5. If he had genuine evidence to support his claim that the theory is wrong, he would probably have provided that.

6. I conclude that he has no such evidence.

7. I also conclude that my own theory; that left-wing politics is currently contaminated by more mutual- and self-deceit than I would like, has received a (very) little more support.

The business (i.e. secular bull & bear market) cycles host the biggest changes in employment regardless (or in spite) of the flavour of goverment in power or their economic policies. These policies including taxation schemes can increase or slow down the rate of boom or bust but doubtful can actually cause a change in direction.

The near 3 decade credit bull market which just ended saw both Tory and Labour governments do well for the most part. Only when the bubble burst did we see Labour’s spendaholic behaviour get into trouble – very much a reflection of the nation as a whole.

“Caveat: Reagan’s extra spending was a mostly a massive arms build-up – calculated to bankrupt the Soviet Union and end the Cold War…. therefore not typical”

But that is not the point.

Reagan pretended to be a free trader, get the govt off our back, cut spending blah, blah, blah merchant , but what he in fact did was run up the biggest debt in American history, by spending huge amounts on the American military industrial complex.

You can dress it up all you like “ as fighting communism” or whatever , but in economic terms it was Keynesianism. Huge govt spending pored into the economy.

WELFARE FOR WASPS

The Trade Weighted Dollar Index was around 100 when Bush W. took over. With Bush inheriting a budget surplus the index continued to rise to around 112, 2002. He then ran up a huge deficit through reckless tax cuts and foreign wars. The dollar index then went into decline reaching 70 in 2008. The dollar then recovered 2008/09 as the financial crisis started a process of deleveraging and the repatriation of dollars back to the US. Now a Democrat is in the White House there is dollar and deficit hysteria.

Some of what they say I agree with. The dollar decline is a concern and nations should live within their means. It is the breathtaking hypocrisy that I object to. However, it would be an irresponsible government who tried to balance the budget in the midst of the current recession. I am not a fiscal conservative in that I believe the budget should always balance. However, I do believe in fiscal honesty and if a government wish to increase spending they should be honest and increase taxes.

@ Daniel

“1. The most recent period of significant financial deregulation was under Clinton.”

Er Daniel. Sure you’re a smart guy but was it not mentioned above that Clinton pretty much carried on with what Raegan did? Ala Blair?

Furthermore, an issue which progressives will always have re the left, is the lack of HUGE financial backing and support.

The US is a historically dogmatic and right wing country, so did Clinton get in bed with certain people? Were his hands tied?

I don’t know why all the right wing posters in this blog always play dumb and my ‘sh*t don’t stink’.

Look, you are pro business. I’m actually pro business. You KNOW how a profit and loss chart works. I’ve had my own business-starting a new one-plus I’m doing an MBA.

With this knowledge, I wouldn’t DARE to spout some of the cr*p that you guys are doing so.

The USA like the UK is supposed to run like a non for profit business, i.e it NEEDS to have big time CSR, whether you like it or not. So because we run countries like a business, lets look at the USA.

For literally a century, like the UK, it has been a predominantly righ wing business with a bottom line of profit. No triple bottom line here!

So when you have that history, pattern, models, partenership building, investments, etc etc that has been completely right wing, what chance does a lefty govt have going into that lions den?

So is it any surprise what Blair and Clinton ended up doing? And now Obama?

So bringing up Clinton is missing the whole point of this article, which is saying that Friedman’s vision aint working.

But hey the amount of times that b*stard has swallowed his words, or like he did in Eastern Europe, blamed the people for the freemarket mess that his created is just so typical of right wing freemarkey evangelists.

Someone mentioned about who there was growth in profit, so Friedman was right. No.

As we all know in a business, don’t get to carried away and ahead of yourself. As with seen with Enron et al, high growth means eff all.

Whats the point of short term high growth that only lines the pockets of the 10% rich elite in the US?

You can have a company making 1billion but how much of that goes to the workers being employed and at what rate are they paid?

Yeah, it looks ACE on your financial statements but the reality is that little more complicated that right wingers refuse to accept.

Sunny

One of the problems with any analysis of the US is that you just cannot learn much from just looking at Federal spending or tax policies in isolation. What happens at State level is too significant.

A study of fiscal years 1994 to 2004 (spanning Clinton and Bush) looked at the relationship between state taxes and employment growth.

The 10 lowest tax states had employment growth 77% higher than the 10 highest tax states.

The 25 lowest tax states saw employment growth 33% higher than 25 highest tax states.

Coincidence or causation? Tim Worstall may have a view.

(“High Taxes Lower Economic Performance,” by J. Scott Moody, The Maine Heritage Policy Center, 2006)

“But hey the amount of times that b*stard has swallowed his words, or like he did in Eastern Europe, blamed the people for the freemarket mess that his created is just so typical of right wing freemarkey evangelists”

Uhh, whats wrong with Eastern Europe? Looked pretty good last time I went round there. You know Poland, Czech Republic, Slovakia. Ok far from ideal, but they are moving from a low base and pretty fast too. Ok, it was a fuck up with Russia, but that was always going to a pretty tough nut to crack, and it is still much better than it was before.

@ Nick

“Ok, it was a fuck up with Russia, but that was always going to a pretty tough nut to crack, and it is still much better than it was before.”

But why? Why go there? After this economic recession stuff I got more into anthropology. Cultures and their patterns etc etc..

Now, how effed up is it to inflict a freemarket concept on every country that you know…just because?

Is market research ever done? Each place that has had this…New Orleans included, after the Hurricain literally all the schools were privatised…(I wonder who made THE money?) but how do you know this is what people want?

It’s just as bad as the extreme lefties with their own ways of how people should live.

Friedman was a nutter though. And I don’t know about you but before I got out with a bloke, I like to understand were he’s coming from, i.e ‘what were mum and dad like?’…

You prolly hate the concept of cognitive behaviour but…I’m waiting to being proved wrong. And Friedman has an angry childhood based on the fact as an Eastern European Jew, he hated that his Dad lost all his money making the family poor. As far as I’ve read, he swore it never happen again…

Sigh.

@ Nick

“Looked pretty good last time I went round there. You know Poland, Czech Republic,”

Is that what your poor mates agreed with?

18. Sunny H – “Ahhh, I was waiting for the right-wingers to turn up and try and make some technical points to undermine what is so obvious there.”

Amusing. What do you think is so obviously there?

“The impact of the New Deal wasn’t entirely immediate, that’s why.”

And yet World War Two is so obviously there. You can look at the graph and see the massive expansion of Government spending in 1940-41, and the massive decrease in 1945, have a more or less immediate impact on the economy. So why do you think the New Deal does not? More interestingly, why do you think your source so carefully did not include the 1920s and the 1930s in this graphic comparison? Do you think that perhaps there has been a deliberate selection of start and end points to make the argument look good?

But if you insist that economic policy lags, and it often does, then, of course, the graph for George Bush Junior and the rest of the Republicans is not showing their records, but the records of their predecessors. After all, if you claim the massive expansion of the American economy in, say, 1944 is due to the New Deal and not World War Two, then it must follow that any decline in 2008 is due to some policy put in place in 1998, not in 2004. You have to be consistent.

“The cyclical downturn wasn’t necessarily cyclical – it came about as a direct result of getting rid of regulation, which allowed unchecked speculation and investment in areas that didn’t actually do any sustainable job / wealth creation.”

Sorry but can I ask what would your evidence for this be? You mean that the Leftist blog echo chamber says it is so, so it must be so? How do you know it was caused by getting rid of regulation? The problems here are caused by sub-prime loans. Housing loans do, of course, create jobs and wealth. As does speculation. Why do you think the Leftist Bloggers like to blame Hedge Funds (or Banks engaging in Hedge Fund-like activities) for this when it is clear that they had nothing to do with it? And needless to say, do create sustainable wealth and jobs and all the rest.

It look to me that the prime cause remains Fannie Mae and Freddy Mac. Federal Government intervention in the housing market which encouraged everyone to lend to anyone because they knew that Uncle Sam would always pick up the Bill for bad loans. As he did.

How do you know it was caused by getting rid of regulation? The problems here are caused by sub-prime loans. Housing loans do, of course, create jobs and wealth. As does speculation.

The sub-prime loans collapse happened because companies were deregulated enough to let them sell bad loans like crazy, and then re-package them so as to pretend that the risk was quite low. As long as everything didn’t collapse of course. Which it did. Who is to blame otherwise? Government perhaps?

Look, weave and duck and change the goalposts as much as you like – but what the graphs show above is pretty clear: that Republicans massively increased deficits during their years, and that they presided over faltering economies despite promising the stars by the way of regulation.

You can’t get away from those facts.

42. Sunny H – “The sub-prime loans collapse happened because companies were deregulated enough to let them sell bad loans like crazy, and then re-package them so as to pretend that the risk was quite low. As long as everything didn’t collapse of course. Which it did. Who is to blame otherwise? Government perhaps?”

Except the regulation was encouraging them, making them even, sell sub-prime loans. Especially to minorities. The repackaging is also key, but again it was Federal regulation that enabled them to claim every re-sold loan bundle was now an asset that enabled them to borrow more and hence lend more. On top of which Freddy Mac and Fannie Mae made sure the risk was quite low. They were buying in the market, they were lending on their own, they were supporting the Bubble, and of course if the worst came to the worst everyone knew they were there to clean up the mess with Uncle Sam’s money.

“Look, weave and duck and change the goalposts as much as you like – but what the graphs show above is pretty clear: that Republicans massively increased deficits during their years, and that they presided over faltering economies despite promising the stars by the way of regulation.”

Sorry but what weaving and ducking would this be? I am not claiming that the graphs of the 1940s show the impact of the New Deal and not World War Two. It is true that the Republicans, some of them anyway, have spent a lot. But it is not true that they have presided over faltering economies. It varies. Reagan did not for instance. What is more his regulatory reforms created the period of growth that followed.

“You can’t get away from those facts.”

I am not trying to get away from any facts. It is the interpretation that matters. For one thing it is interesting to see how well the Government has in fact managed cyclical downturns since Reagan. That is a very long period of more or less uninterrupted growth. Apart from that, the economy does not seem to respond all that well to the Government’s policies. The big decline is in 1945, as you would expect, and that has nothing to do with economic management. The rest are mild downturns in more or less uninterrupted economic growth. Given the Classical Liberal quasi-consensus that exists in American economic policy this seems to be a triumph for the (by British standards) Right. It would be very interesting to see a British or French comparison.

. Given the Classical Liberal quasi-consensus that exists in American economic policy this seems to be a triumph for the (by British standards) Right.

Not exactly – since Milton Friedman didn’t become popular until Reagan really. And even then he was ignored when Reagan realised how unlikely his programme was to work.

I’m not against capitalism by the way. I disagree on various interpretations. The first is that government spending is always bad. I also don’t buy Republican noise on how good they are at managing economies. I also don’t buy the view that less regulation is always good. You say the regulation encouraged them to sell sub-primes. How exactly? And wouldn’t you be for regulation to stop that? Lastly, I think a govt can stimulate and grow industries that help the economy over the long term. My point with these graphs was to show that neo-classical economics doesn’t stand up to scrutiny. There’s been plenty of explanations offered, but the point is that the evidence to support Friedman is pretty thin on the ground.

“My point with these graphs was to show that neo-classical economics doesn’t stand up to scrutiny. There’s been plenty of explanations offered, but the point is that the evidence to support Friedman is pretty thin on the ground.”

Well, if you want to say that there’s little evidence to support neo-classical economics then you’ve got to go all the way back to Marshall in the 1890s then. For that’s what “neo-classical” refers to. Things happen at the margin and so on. Don’t think you’ll get all that many economists to agree with you.

As to Friedman, well, just about everyone says he’s right on some things. Inflation is a monetary phenomenon for example (and therefore so is deflation).

In fact, it was Friedman’s study of the Depression which convinced everyone that we mustn’t let the monetary base collapse in the aftermath of a financial crisis. Thus the quantitative easing by both UK and US this time around.

That there’s “little evidence to support Friedman” is of course why everyone is indeed using monetary measures (as well as fiscal) at the moment. Odd how people doing what you insist they do is evidence that you’re wrong somehow.

“You say the regulation encouraged them to sell sub-primes. How exactly?”

The Community Reinvestment Act insisted that banks make sub prime loans. I’m not sure how much that had to do with subsequent events: I’m happy enough with the explanation that this was simply one of the manias that markets are subject to (South Sea Bubble, Tulips, railways, canals, internet, we’ve seen it before and we’ll see it again.). But yes, banks had to, legally, make sub prime loans.

“Lastly, I think a govt can stimulate and grow industries that help the economy over the long term.”

I accept the logical case that it is possible for this to be done. Assuming a near omniscient and benevolent set of politicians.

“I also don’t buy Republican noise on how good they are at managing economies.”

Nor do I. Nor the Tories. Nor any other group of politicians. For they’re not omniscient and they’re not benevolent. Public choice theory tells us that they’ll always make the decisions which are good for politicians (ie, get them re-elected) rather than what’s good for the rest of us.

Thus why they can’t stimulate industries for example. What might be done to do so will always be distorted by callow electioneering. GM/Chrylser was a giveaway to the UAW, which is very powerful in Democratic circles. Rover got State aid because it affected a number of important West Midlands marginals just before an election.

Which is one of the reasons I’m so pro-market and anti-politics. Political decisions are taken with the wrong incentives in mind. Thus they’re hugely likely to be bad decisions: the ones that do work do so purely by happenstance.

Try Tyler Cowen: Why I disagree with Milton Friedman on monetary policy

http://www.marginalrevolution.com/marginalrevolution/2006/08/why_i_disagree_.html

And this:

“In 2003, [Milton Friedman] publicly declared in the Financial Times that monetarist policy had failed. ‘The use of quantity of money as a target has not been a success … I’m not sure I would as of today push it as hard as I once did,’ he said.”

http://www.guardian.co.uk/business/2006/nov/16/usnews.internationalnews

This entire discussion thread seems to be based on an economic understanding that ended in the 1960s. Modern economic thinking suggests that temporary, deficit-funded tax cuts won’t affect employment, because people will foresee a need to balance the budget in the future, so they will save the tax cut rather than spend it to prepare for the fiscal tightening to come. Tax cuts or increases not compensated by spending cuts or increases shouldn’t change the employment level all that much. Reagan tax cuts were instead defended by the Laffer curve idea, which didn’t work.

As for Sunny’s argument, how come we can ascribe job growth to the New Deal several years after the fact, but we can blame Reagan for a recession that began during and after his election?

“Modern economic thinking suggests that temporary, deficit-funded tax cuts won’t affect employment, because people will foresee a need to balance the budget in the future, so they will save the tax cut rather than spend it to prepare for the fiscal tightening to come.”

Not sure that’s “modern”. That’s Ricardian Equivalence which has a very long and storied history. And it’s a very difficult theory to uphold purely for tax cuts. If it does hold* then it also holds for deficit spending. Meaning that fiscal expansion via either tax cuts or increases in spending doesn’t work.

* It does hold for both in fact but not entirely. Some people will save some of any either tax cut or debt funded increases in spending. I (for whatever minor value my thoughts have) think that it’s most unlikely to be either all people of all of it or no people of none of it. So it reduces the effectiveness of either course but not eliminates it entirely.

“My point with these graphs was to show that neo-classical economics doesn’t stand up to scrutiny”

Sunny, I’m afraid you are really mis-using the term “neo-classical economics” and I genuinely think you should stop using that term and replace it with something else. Neo-classical economics does not mean the set of policy recommendations you associate with the right wing, it does not mean monetarism or inflation targeting, it does not mean a belief that government is less efficient than the private sector or anything like that. The term refers to a certain way of doing economics, and if you wanted to you could use neo-classical techniques to make a case for heavy government intervention, Keynesianism etc. All that stuff about externalities, public goods, sticky prices, complementary production inputs, information problems, market failures etc. is all expressed in neo-classical terms.

It is true that lots of neoclassical economists have made the policy recommendations you disagree with, but that doesn’t make the two equivalent.

Sunny

You are reading your own graph wrong if you conclude (as you do) that in the George W. Bush period there was little job growth in the US economy and that his tax cuts didn’t work.

Just look at the raw figures:

*September 2007 is the 49th consecutive month of job growth, setting a new record for the longest uninterrupted expansion of the U.S. labor market. Significant upward revisions to employment in July and August mean employment growth has averaged 97,000 per month over the last three months. Since August 2003, our economy has created more than 8.1 million jobs….

* Real after-tax per capita personal income has increased by over 12.5 percent – an average of over $3,750 per person – since President Bush took office. More than 30 percent of the Nation’s net worth has been added since the President’s 2003 tax cuts

* Real GDP grew at a strong 3.8 percent annual rate in the second quarter of 2007. The economy has now experienced nearly six years of uninterrupted growth, averaging 2.7 percent a year since the turnaround in 2001. (US Bureau of Labor Statistics October 5 2007).

Go figure…

@50

Oh Bloom, nice try. But the problem is that the jobs being talked about in that report are not the kind of jobs that sustain an economy – by and large they were short-term contract work, fast food and Wal-mart greeter level jobs. And when people tried to call the Bush Administration on it, they said they were re-classifying fast food work as a manufacturing job in order to fiddle those numbers.

“Political decisions are taken with the wrong incentives in mind. ”

Well yes, and this is exactly why advocating pigou taxes as the main solution to environmental problems/externalities is flawed, although that still doesn’t stop you advocating them as a solution. In fact, if the criteria of political possibility was applied to most of the policies you (and for that matter virtually everyone who writes a blog) then the percentage of policies passing this test would be very low indeed.

I think the more interesting question is why is the incentive structure the way it is, and what can be done to change this? Which brings us into discussions of consitutional reform, reform of political culture, the role of the media etc.

“Well yes, and this is exactly why advocating pigou taxes as the main solution to environmental problems/externalities is flawed, although that still doesn’t stop you advocating them as a solution.”

That is indeed the best argument against Pigou Taxes that there is. However, the same argument applies even more strongly to any of the other possible alternatives: cap and trade, regulation, bans on certain activities and so on.

“I think the more interesting question is why is the incentive structure the way it is, and what can be done to change this? Which brings us into discussions of consitutional reform, reform of political culture, the role of the media etc.”

And my rather gloomy conclusion is that there isn’t a solution to this. Politics will always be compromised in this manner,. Which is why I argue that as little of our lives as is possible should be either regulated or determined through the political process.

Sometimes it’s necessary: as with free rider problems like climate change (transactions costs are simply too high for a Coasean private contractual arrangement to be feasible). Sometimes we just do have to use the appallingly compromised and malincentivised structures of governemnt and politics: but they are compromised and malincentivised and they always will be, so we should use them only when we absolutely have to.

Some of us have long been aware of the notion of Ricardian Equivalence as paraded around by Robert Barro..

If Ricardian Equivalence is taken seriously by treasury advisers in G7 countries then how come the US, Germany, Japan etc applied so much larger fiscal boosts relative to their national GDP than Alistair Darling’s comparatively modest boost of c. £28 billions announced in the PBR here last December?

Compare that £28 billion with this:

“Feb. 11 (Bloomberg) — U.S. lawmakers agreed on a $789 billion economic stimulus plan that President Barack Obama said is urgently needed to keep the country from sliding into a deeper recession.”

http://www.bloomberg.com/apps/news?pid=20601087&sid=aeJYLHy8kV1U

Larry Summers is the Director of the US National Economic Council based in the White House. Any claim that he (previously economics prof at Harvard) was unaware of the notion of Ricardian Equivalence beggars belief.

Tim Rand “Which is one of the reasons I’m so pro-market and anti-politics. Political decisions are taken with the wrong incentives in mind. ”

Yea, those bankers made such great decisions, din’t they?

What Tim Rand and his Milton really belives in ius that the rich should have lots of choices and the poor none.

For a balanced assessment of the effectiveness of discretionary fiscal policy as one stabilization tool in the toolbox of national treasuries, try this paper by Alan Blinder: The case against discretionary fiscal policy

http://www.princeton.edu/ceps/workingpapers/100blinder.pdf

Before returning to a professorship at Princeton, Alan Blinder served as Vice Chairman of the Board of Governors of the Federal Reserve System from June 1994 to January 1996:

http://en.wikipedia.org/wiki/Alan_Blinder

Tim,

There may not be a solution to this, but different systems produce different results. I think we would agree, for example, that the incentives on political leaders to produce rational policies are greater in representative democracies than in dictatorships. Even within democracies there are such a wide range of systems and incentive structures that I think a “government = bad” approach is far too simplistic. Different structures create different results, some produce good ones, others don’t.

In the case of the problem with applying keynesian economic policies you mention, there are obvious structural changes one could make to ensure the policy becomes viable and politicaly possible. Actually I’ve always thought large deficits were unconstitutional in the UK because they bind future parliaments – now if only we had some form of enforcement mechanism to ensure that governments had to balance budgets over a parliamentry cycle…

Besides, the externality problem I refer to demonstrates markets are also imperfect and can produce large externalities- even in a state of nature. And my rather gloomy conclusion is that there isn’t a solution to this. Markets will always be compromised in this manner,. Which is why I argue that as little of our lives as is possible should be either regulated or determined through the unltra free market process.

![]()

(couldn’t resist)

Crowding out is only one (and the most debatable) economic argument against big government. The more convincing ones are

Big government is expensive, it requires big taxes. All that tax is money not being spent on goods in the economy

Even when government spending stimulates growth – it is British indutrys single biggest customer and under nu labour the biggest spender on advertising – it does so inefficiently, consuming a significant overhead in “recycling” the money back into the market. An extreme example this is the CSA (or whatever it got rebranded as) which costs £8 to run for every £1 in child support it collects. The tax credits system is also notoriously prone to error and fraud

Government should stick to what markets can’t/won’t provide on their own – long term infrastructure and merit goods.

“Government should stick to what markets can’t/won’t provide on their own – long term infrastructure and merit goods.”

But the Rands don’t believe the govt can do anything.

What you are really saying is what all conservatives want, which is the govt to provide welfare for WASPS.

Matt @ 58

‘Big government is expensive, it requires big taxes. All that tax is money not being spent on goods in the economy’

Er, where is it being spent then, Matt? It isn’t being taken down to land refill and burnt is it? Surely the wages and benefits are keeping thousands, if not millions in work?

One mans ‘inefficientcy’ is another man’s wages.

Sally – Explain “Rands” and “Wasps”

Jim – It’s being spent on more big government, if I pay a pound in taxes, it’s a pound I cannot spend in the shops, yes it will eventually get spent by government somewhere but a percetange of it is lost (at the moment to debt repayment), not generating economic growth.

For an alledged right winger I actually beleive in well funded public services providing public goods, and for that you need taxes. What I don’t beileve is a self-perpetuating, ever expanding state, because it invitably leads to the money running out and the country being run on credit (which is where we are now)

Matt @ 61

It’s being spent on more big government, if I pay a pound in taxes, it’s a pound I cannot spend in the shops, yes it will eventually get spent by government somewhere but a percetange of it is lost (at the moment to debt repayment), not generating economic growth.

But it is still being spent though. Even ‘big government’ must be buying something with it. Even if it being spent on binders, marker pens and flip charts someone is getting value from it. Even if it spent on cans of wife beater, frozen pizzas and scratch cards someone needs to make, print, deliver, stack and checkout them.

Surely all that counts as ‘economic growth’? The more transactions the more growth. Isn’t that GDP?

44. Sunny H – “Not exactly – since Milton Friedman didn’t become popular until Reagan really. And even then he was ignored when Reagan realised how unlikely his programme was to work.”

Milton Friedman was not a Classical Liberal economist. He was a neo-Liberal. He was part of the revival of that Classical school. But America was founded in the pre-French Revolution, pre-Socialism, Classical Liberal world. Classical Liberalism – the world of Adam Smith, Hume, and even J S Mill – is much stronger in America than in Britain. So by British standards the Democratic Party up to the end of the Vietnam War, was a Right Wing Party.

“The first is that government spending is always bad. I also don’t buy Republican noise on how good they are at managing economies. I also don’t buy the view that less regulation is always good.”

I don’t think anyone says that Government spending is always bad. But I think it is a reasonable presumption that it will be unless it can be shown otherwise. I don’t accept that anyone in particularly good at managing economies. I don’t think anyone knows what they are doing, but the Classical Liberals think we should intervene as little as possible and so it is likely they will do as little damage as feasible. Nor do I know of anyone who thinks less regulation is always good. But regulations impose hidden costs and they have perverse outcomes and so, again, the smart money is that they will make something worse. As usually seems to happen.

“You say the regulation encouraged them to sell sub-primes. How exactly? And wouldn’t you be for regulation to stop that?”

The Banks had a legal obligation to lend to deprived communities. Sub-primes in fact. They have been repeatedly sued for refusing to lend adequate amounts in certain communities. On top of which Freddy Mac and Fannie Mae merely exist. Freddy Mac exists specifically for the purpose of creating a secondary market in housing loans. A bank lends to someone, they take that loan and sell it to the Feds in the form of Freddy Mac, they bundle it up and re-sell it as a prime investment even though it may be sub-prime. Because now it has the de facto guarantee of Uncle Sam all over it. They exist to expand the amount of money the housing industry has available, their purpose is to increase lending for housing. Which they have done very well. You don’t think that this had an impact on the collapse of that secondary market?

“Lastly, I think a govt can stimulate and grow industries that help the economy over the long term.”

That I do not agree with. The Government cannot make sensible long term decisions. Their outlook is to the next election. Nor can they usually muster the courage to choose the future over the past. They will not close down old and declining industries even if that is necessary to create new ones. Because the older workers vote and the unborn do not – nor do the benefits of new industries concentrate in the way the costs of closing old ones do, they are diffused across society. Nor do they, or can they, know where economic growth is going to come from. They cannot concentrate on a new field because they are just not that smart. No one is. The Japanese and the South Koreans could copy the West’s economic history, but once they caught up with the West they could no longer tell where new growth was going to come from and the Japanese have been stuck ever since.

“My point with these graphs was to show that neo-classical economics doesn’t stand up to scrutiny. There’s been plenty of explanations offered, but the point is that the evidence to support Friedman is pretty thin on the ground.”

And I think they show the opposite. But as there is a quasi-Classical Liberal consensus in the US, you would need to look to a country that has competing and radically different economic views. France for instance. Britain perhaps. But when it comes to the economy, the Democrats and the Republicans are not that far apart.

Boooring.

Would be great to actually get some honest dialogue. So can anyone answer my queries?

Why do mortgage loans happen? What happmes with the 3rd year part of a financial statement showing high growth?

You’re all going round in circles. Do you care? Don’t think so but come on…

SROI

Social Return Of Investment!

Whhhhhy do people get mortgages?? Is is bullish call centres?? Or crazy marketing to buy a house!??

Social.

That I do not agree with. The Government cannot make sensible long term decisions. Their outlook is to the next election. Nor can they usually muster the courage to choose the future over the past.

I have a few quibbles about earlier points but I’ll stick to this. A lot of major development has been spurred by government programmes, from Laser, the internet, road building programmes and much more. The government’s plans to build high-speed railway services (if the Tories allow it to happen) would be another example. Most scientific development is government funded through universities – and it can be long term.

You’re confusing the difference between campaigning governments and money that can be allocated towards longer-term projects.

The Japanese and the South Koreans could copy the West’s economic history, but once they caught up with the West they could no longer tell where new growth was going to come from and the Japanese have been stuck ever since.

This is quite simplistic and I did my dissertation looking at how the Japanese economy looked at innovation. Japanese culture discourages risk-taking innovation that requires people to throw all their money on pet projects in the way that many Americans do. Instead their companies focus on improving existing technology and taking them further. And most of R&D takes place with big corporations. Which means their path to innovation is different (incremental rather than creative destruction) – but it doesn’t mean they’re not good at developing.

China, by the way, is investing billions now in green technolgy, sustainable energy and derivatives because it think thats where the future lies (and I agree). Sure, it’s impossible to predict – but its also easily arguable that because American/US stockmarkets reward short/medium term gains than long-term development – companies don’t think that long term either.

“A lot of major development has been spurred by government programmes, from Laser, the internet, road building programmes and much more.”

“Most scientific development is government funded through universities – and it can be long term. ”

You’ve got two quite different things here. Invention and innovation. One of the scholars of this area is William Baumol. He defines invention as,well, invention. The finding or making of new stuff. This can indeed be done in many different systems.

Then there’s innovation: this is used in a slightly different sense here. What he means is the adoption of that spiffy new invention across the economy.

Say, umm, mobile phones. The oroginal technology was developed in the Swedish state telecoms company (I think, Alex and Yorkshire Ranter said so at least). That’s what Baumol would call the invention part. The innovation part is getting the population both able to use it and actually using it: that’s what adds the value after all, using spiffy new stuff, not just the fact that it exists.

And it’s pretty clear that competitive firms in a market roll out such technologies faster than government does. Or even a single monopolisitc private firm.

“Surely all that counts as ‘economic growth’? The more transactions the more growth. Isn’t that GDP?”

No. GDP is the value added in a transaction. For example, the buying and selling of shares is not part of GDP (ie, the transaction isn’t). Only the commissions to the stockbrokers are part of GDP.

With Government it’s worse than that. For we can’t measure the value that government adds so it is assumed that output value equals input value. Thus the addition to GDP figures by government is whatever we spend on government.

So we account for entirely unproductive paper shuffling as being the same addition to GDP as we do, say, something useful and productive being done by government, like emptying the bins.

It’s another one of those failures of GDP as a measure.

How right-wing economics has trouble standing up – that’s as opposed to the total financial disaster that every single labour government has ended with?

Could anyone point to a country practising ‘left-wing economics’ that is economically successful?

@68 At the risk of annoying Tim, Sweden.

*Ducks*

Although they do have a small open economy they redistribute heavily. Also, on the way to becoming a small open economy, it made extensive use of public private cooperation in infrastructure, and some key industries like iron.

In general catch-up developers always have quite interventionist states. As a rule, the later the catchup the more work the state has to do.

“Although they do have a small open economy they redistribute heavily.”

Indeed. And as I love to point out they actually run their economy in a more “right wing” manner than we do.

Their taxation system for example taxes capital less than ours (and companies less than ours), incomes a bit more and consumption very much more than we do. Which is pretty much what the neo-classicals would say you have to do if you want to have both a growing economy and high levels of redistribution.

Similarly, look at their reaction to no one wanting to buy Saab. OK, close it down then! Would that this had happened with British Leyland, GM, Chrysler, Rover…..

Can we give you Lithuania, and Richard Murphy Latvia and see who wins?

Left Outside @ 69

Thanks, but for the reasons Tim W mentions plus the fact that it currently has a centre-right government, Sweden doesn’t really fit the bill.

The whole point of this thread is to discuss Sunny H’s contention that ‘right-wing economics doesn’t stand up.”

Surely there MUST be at least one country in the world that is doing things in the more left-wing way that Sunny H would prefer and proving successful?

Surely one?

Well, Matthew Yglesias has looked at the more egalitarian European countries compared with the unequal US and not found much difference in performance.

Although unemployment has tended to a higher rate, its less unpleasant and in general “social democracies” work shorter hours without being particularly worse off. Which sounds like a win to me.

Those asking for apparently elusive examples of successful “left-wing” economic policies might like to read this piece by John Kay in Wednesday’s Financial Times on:

Unfettered finance has been the cause of all our crises

http://www.ft.com/cms/s/0/1a073a16-fa63-11de-beed-00144feab49a.html

I’ve a strong personal aversion to the labels “left-wing” and “right-wing”, except in quotes, because I’m seldom clear on the connotations of either. Hitler is usually described as right-wing but the formal name of the Nazi party was the National Socialist German Workers Party and the party’s official programme of 1920 contained many policies often found in the manifestos of European socialist and social democrat parties.

This may come as a terrible cultural shock but credit for first implementing a national insurance scheme for healthcare costs goes not to Britain for creating the NHS in 1948 but to Count Otto von Bismarck, first Chancellor of the German Empire.

“The Health Insurance bill . . was passed in 1883. The program was considered the least important from Bismarck’s point of view, and the least politically troublesome. The program was established to provide health care for the largest segment of the German workers. The health service was established on a local basis, with the cost divided between employers and the employed. The employers contributed 1/3rd, while the workers contributed 2/3rds . The minimum payments for medical treatment and Sick Pay for up to 13 weeks were legally fixed.”

http://en.wikipedia.org/wiki/Otto_von_Bismarck

Whatever else, Count Bismarck had no socialist sympathies whatever. Quite the opposite, in fact.

Perhaps someone could point me to books which set out an agenda for left-wing economics, rather like Joe Stiglitz on: Whither Socialism? (MIT Press 1994)

http://en.wikipedia.org/wiki/Whither_Socialism%3F

And Richard Wilkinson and Kate Pickett: The Spirit Level (Allen Lane 2009):

http://www.guardian.co.uk/books/2009/mar/13/the-spirit-level

Andre Gorz ‘Farewell to the Working Class’ (Pluto Press 1982) also outlines a socialist economic system which, surprisingly, does not attract that much cricism from liberals. Gorz, unfortunately, has never really taken off in the UK, his theories are far more popular on the continent, and, particularly, in his native France. Uniquely, he manages to ‘marry’ marxism, liberalism and green issues. Not a perfect theory but the best I know of.

Reactions: Twitter, blogs

-

Paulo Coimbra

RT @libcon: :: How right-wing economics has trouble standing up http://bit.ly/7v4Ufq

-

David Jones

You couldn't make it up. @pickledpolitics: I was waiting for right-wingers to try and make some technical points http://tinyurl.com/yjfz29q

-

Liberal Conspiracy

:: How right-wing economics has trouble standing up http://bit.ly/7v4Ufq

-

Tweets that mention Liberal Conspiracy » How right-wing economics has trouble standing up -- Topsy.com

[...] This post was mentioned on Twitter by Liberal Conspiracy, Paulo Coimbra. Paulo Coimbra said: RT @libcon: :: How right-wing economics has trouble standing up http://bit.ly/7v4Ufq [...]

-

ray bryant

proof that conservatives dont have a clue https://liberalconspiracy.org/2010/01/04/how-right-wing-economics-has-trouble-standing-up/

-

Elizabeth G.

How right-wing economics has trouble standing up « Liberal Conspiracy

http://bit.ly/8Rg7EO -

Jack DeTate

RT @Taelasky: How right-wing economics has trouble standing up « Liberal Conspiracy

http://bit.ly/8Rg7EO -

The Right and Economics « Freethinking Economist

[...] Tagged: Chicago School, Economics, Monetarism, Politics, Quantitative Easing. Leave a Comment Sunny on Liberal Conspiracy used recent growth levels during various administrations to prove that the Right is all at sea, [...]

-

sunny hundal

@OliverCooper most of that "spending" was to prop up banks, to keep lending going. Besides, state expanded under Right http://bit.ly/7v4Ufq

-

sunny hundal

@allanholloway @SimonG_1 only idiots (aka right-wingers) look at nominal figures. Smoke on this http://t.co/5g01z1aM & http://t.co/UxtEEBga

Sorry, the comment form is closed at this time.

NEWS ARTICLES ARCHIVE