Will tomorrow be the day people start to question Osborne’s competence?

8:40 am - July 25th 2011

| Tweet | Share on Tumblr |

Tomorrow today we find out how badly the UK economy has been doing for the past 3 months. It is important because it may also be the day politicos wake up and realise our economy is in deep trouble and George Osborne has little idea how to revive it.

By most predictions it will be a bad figure for the Chancellor: ranging from negative growth (massive disaster) to around 0.8% growth (still a disaster). As Ed Balls pointed out yesterday, Osborne needs 0.8% just to hit his targets (and bring the deficit down).

Let’s be clear about this: many of us on the left warned a year ago the Chancellor’s austerity strategy would not work. A year later, the evidence is mounting up against him.

Here is the main problem: the left has repeatedly said the austerity budget would depress the economy at a time it needed to be propped up. People’s jobs needed protecting and they needed more cash in their pockets to feel confident things would get better.

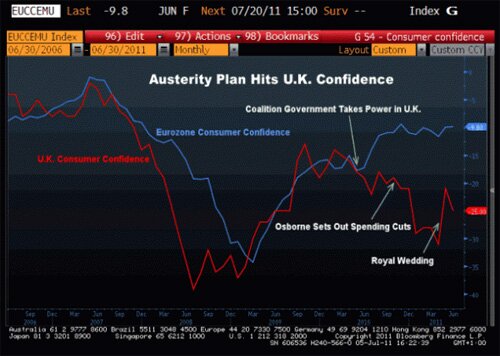

Osborne did the exact opposite: he threatened massive job cuts (and shifted thousands of people into part-time employment) and raised taxes on consumers through VAT. The Guardian reports today that household confidence continues to drop and falter.

This graph by Bloomberg says it all

Vince Cable will today finally admit the nub of the problem: “There is a genuine problem with demand, especially consumer demand.” Indeed. But the government has no idea how to revive it.

Osborne’s focus is instead on helping big businesses and hoping for the best. But as Duncan Weldon pointed out recently, even the Corporation Tax cut isn’t working.

Even Osborne’s allies have no clue. Yesterday’s Telegraph stated:

Yet while we applaud Mr Osborne’s rhetoric, we have heard similar promises before – and they have yet to be matched by a clearly defined and coherent push for growth.

It then went on to argue for less regulation for retailers and… a vague demand to “extract concessions from Brussels which could contribute enormously to his growth strategy”.

There are two important points to make:

First, the only way to reduce the deficit and the national debt over the medium and long term is by growing the economy. Given that consumer spending powers a majority of that growth, this government cannot achieve its targets unless it puts more money in the hands of consumers, rather than big businesses.

The plan to reduce the deficit have been an utter disaster from an economic perspective, even if they are slowly achieving Osborne’s long-term political aim of destroying public services.

Second, the Chancellor cannot have it both ways on the cuts. Last year he said that unless the UK cut spending massively, it would face a Greek style meltdown and a credit-rating downgrade.

Now he’s claiming he has made hardly any cuts to spending and saved the economy. Both cannot be true: he has to either concede the UK never was comparable to Greece, or the cuts have been drastic enough to stave off a crash. Then we can examine that claim in more detail.

In the meantime, tomorrow is the day it’s time to kill off the fantasy that Osborne has a viable growth plan for the economy. He has yet to produce one and show its working.

| Tweet | Share on Tumblr |  |

Sunny Hundal is editor of LC. Also: on Twitter, at Pickled Politics and Guardian CIF.

· Other posts by Sunny Hundal

Story Filed Under: Blog ,Economy

Sorry, the comment form is closed at this time.

Reader comments

UK GDP figure is released to Osborne today but only publicly released tomorrow.

Of course, there are many of us who have questioned Osborne’s competence since before he entered No.11. ;0)

The GDP estimate release is tomorrow.

“many of us on the left warned a year ago the Chancellor’s austerity strategy would not work.”

It’s considerably more than a year now, in fact. Labour and the Lib Dems said over and over again during the election campaign that cuts in 2010/11 risked choking a fragile recovery.

Oh for god`s sake this is so tiresome. The answer is borrow and spend …now what`s the question?

The real danger of this sort of silly dream -think magic hat nonsense is that politicians all over the world and primed to listen .You think they want the thankless task of stopping the never never ponzi scheme boosters like snake oil Sunny are so committed to ?

Osborne`s competence …pah !

“There is a genuine problem with demand, especially consumer demand.”

But do we really want to go back to the levels of demand seen before the crash, given that it was largely funded by an unsustainable debt bubble?

[4] Paul: what, in your opinion, is the cause of the “ponzi scheme” (as you call it)?

Clue: politicians of all parties are signed up to it to a greater or lesser extent.

“But do we really want to go back to the levels of demand seen before the crash, given that it was largely funded by an unsustainable debt bubble?”

It’s easy to not get back to that level, assuming enough is done with banks to stop the kind of lending that was allowed to go on. However at the same time putting people out of jobs, while not tackling that area of accruing debt is surely leading us in to more of the same (people without money, needing to borrow to do things that they’re used to, even after cutting their spending which is damaging to economic growth)?

My mistake re: release of figures. I’ve amended the article now

Point still stands however 🙂

Just like to point out that 0.8% quarterly growth (or about 3.2% annualised growth) is very good considering that our post-war average is about 0.55% per quarter – so not a disaster. In fact at that rate, the problems in our economy would sort themselves out very quickly. Whilst I respect the points you are making, I would appreciate if you wouldn’t exaggerate; there is no need and it undermines your credibility.

@ Paul Newman

“The answer is borrow and spend”

Well, part of the answer *is* borrow and spend! No-one denies that. Not one single right-wing kook – here, in the US or anywhere else – thinks economic recovery could happen without governments borrowing and spending large sums of money every year for at least the next four years.

“now what’s the question?”

I’m glad you asked. The big questions, I guess, are: 1- how much discretionary borrowing and spending should the government do every year, and for how long, in order to close the deficit as quickly as possible? (Too much and the deficit could stick around even if strong economic growth means tax revenues climb and non-discretionary spending, on unemployment benefits etc., falls; too little and a lack of economic growth could mean the deficit sticks around due to low tax revenues and rising non-discretionary spending.) And 2 – by how much should the government raise taxes? Too little and the deficit could stick around because economic growth won’t lead to a big enough rise in tax revenues; too much and the deficit could stick around because a lack of private spending leads to a lack of growth and weak tax revenues. Other questions concern the *timing* of spending cuts and tax rises.

Again, nobody denies any of this. Where people disagree is over the details of how much to cut spending, when and on what; how much to raise taxes, when and on whom, etc.. The fact that it looks as if Osborne has delivered three quarters of economic stagnation suggests he may have got it wrong.

“silly dream -think magic hat nonsense”

Erm… ‘expansionary fiscal contraction’?

Mike -The cause of our problems to a large extent, is the Labour Party simple as that. They paid for Nordic services with UK taxes (plus a bit ) thus building a lethal structural deficit during an over heated asset bubble . As for the supposed role of Osborne well we have hardly cut a ha’penny thus far so any supposed austerity cannot be blamed except by determined fantasists

I think what we are seeing is the result of the sclerotic Euro zone clinging onto eachother like drowning men all hoping someone else will start swimming. We are also seeing the result of demand mismanagement over a long period combined with huge damage caused to the supply side by the swollen client state of graduates.40% of these are now engaged in the comically over managed Public Sector rather than doing anything useful.

It is so typical of the left to go on and on about throwing more borrowed money at “it” without ever thinking about what ‘it’ is.

Possibly, though it’ll be a waste of time.

It’s his motivation they need be concerned with.

GO- Alright then GO If you want the pedant world cup its yours. No I am not suggesting we can stop borrowing natch ,although your characterization of this as a “policy” is a bit hallo gatepost -hallo Noddy. The escalation of our National debt was not a policy any more than flying through the window screen when you hit something is a Policy

Calls on the Exchequer were set up that could only be afforded in a boom ..New Labour did that

The answer can only be some version of bringing spending and revenues back into line and politicians and the left are saying we should …’go for growth’ .which is what they always say, echoing Michael Foot “ like any business we will have to borrow to grow”… In practice there is limit to what can be produced form taxation without damaging the Economy and we are on the edge of it . Certainly there is nothing to be got from the rich. Demand is not the problem it is the failure of the supply side to respond ..or are you suggesting we are under borrowed ? Seriously ?

You have left risk out of your equation a bold position given the recent exceedingly worrying bond auction and events in the Euro zone .I see you are from the land of the free. Allow me to introduce you to the idea that there may not be an unlimited amount of ultra low interest borrowing available. I appreciate that America is in a very different position but over here, honest, sticking your hand out ,..again , doesn’t always work.

At the moment the UK is effectively trading on its long history of political stability and the fact it has never defaulted ( had the IMF in though when you people were saying all the same things you are now )Again such a question would mean little to you but the true problem is how to reduce the burden of Public Sector waste and distortion without prompting large scale union unrest ( we have that you know ). We are running Greek level deficits with German interest rates our position is desperately dangerous …

Yours is nice and safe by comparison…….

George Osborne has competence to start with???

Paul –

It’s hardly pedantic to point out that the line you try to draw between loony lefties who think we should ‘borrow and spend’ our way out of recession and sensible right-wingers who think otherwise just doesn’t exist. Nor does the line between sensible right-wingers who accept that the deficit is to high and loony lefties who don’t. We can all agree that we need to close the deficit in the medium term, and we can all agree that doing so depends on our cutting spending and raising taxes neither so much that growth is weak, nor by so little that the deficit sticks around in spite of strong growth.

It useless to just labour the point that we can’t just keep on borrowing indefinitely. We all know that. The question is whether more borrowing now is going to mean less borrowing later (because it will promote growth and so boost tax revenues and reduce the need for spending on unemployment benefits etc.), or whether on the contrary less borrowing now will mean less borrowing later (because something like ‘expansionary fiscal contraction’ will promote all the growth that’s needed). One can consistently oppose Osbornomics *precisely because* we can’t just go on borrowing indefinitely; if his policies lead to weak growth, the deficit is going to remain higher for longer.

G.O.: “Well, part of the answer *is* borrow and spend! No-one denies that. Not one single right-wing kook…”

Eh? Have you not noticed that the Tea Party are attempting to stop the US government raising the debt ceiling?

The big issue with the current government’s austerity plan – as pointed out by the article – is whether it will actually decrease the debt at all, since throwing loads of people out of work while slashing benefits for the unemployed to the extent that they can’t pay for both rent and food will tend to cause a sudden drop in consumer spending and hence taxes paid.

If they seriously want to decrease the deficit they’ll have to aim in other places where the boomerang effect won’t happen, like taxes on wealth and property. But the whole point of the Tories as a party is to resist such taxes, so that won’t happen.

Here are Cameron’s latest words of wisdom:

“The right step for an economy like ours is to get on top of your debt and your deficit and then make it a better place for businesses to grow and expand and employ people.”

So remember – if we continue to see little or no growth over the coming months and years, it’s all part of the plan. We’re only going to worry about growth *after* we’ve got on top of our debt and deficit. Somehow.

jungle,

G.O.: “Well, part of the answer *is* borrow and spend! No-one denies that. Not one single right-wing kook…”

Eh? Have you not noticed that the Tea Party are attempting to stop the US government raising the debt ceiling?

Yes – they want to borrow and spend at the present level, not increase the spending. You do not need to increase borrowing to be borrowing and spending – the government is doing it even as they cut spending, because income is that much lower than expenditure.

Simple thought might help here you know – don’t just jump to conclusions.

The debt ceiling issue is about spending and commitments that have already been made by Congress. Reneging on promises already made or cutting future spending is a budgetary issue and not a debt ceiling issue.

jungle –

As I understand it, the Tea Party types aren’t demanding that the government stop borrowing and spending. They’re threatening to engineer a situation in which the government *has* to stop borrowing and spending, with consequences they acknowledge would be undesirable, if Obama doesn’t agree to further spending cuts in place of proposed tax rises.

@11 – NORDIC services? No, nowhere CLOSE.

You’re outright delusional to even mention that kind of nonsense.

It’s classic misdirection.

Conservative economic terrorists know that austerity wont eliminate the deficit but that was never the real goal, it was just a smokescreen. Conservative economic terrorist cult leaders are evil but they are not stupid, like their sun reading followers.

Their real mission is the complete destruction of the welfare state and the privatisation of everything to make the rich richer at the expense of the poor. They keep misdirecting everyone by saying “our plans will soon work to lower the deficit just be patient” so everyone thinks that is their real aim when in actual fact they couldn’t care less about the deficit they just want to destroy the last vestiges of the post war settlement. They just hope they can keep the smokescreen going long enough to complete their real mission.

The sooner people understand this the better.

The estimate of q-on-q of 0.2% is not sparkling, but considering the extra bank holiday is around long term growth. Considerably better than the increasingly bearish Duncan has been predicting.

Annualised rate of growth Q4 2009 – Q2 2010: 2.4%

Annualised rate of growth Q4 2010 – Q2 2011: 0.27%

So growth is only 89% slower than it was a year ago. That’s not too bad, is it? That’s positive news. Could have been worse. Don’t know what these whining lefties are so worried about.

“There is a genuine problem with demand, especially consumer demand.”

Maybe stand up Alun Cochrane has a point when he says’ Maybe the problem is more and more of us are realising we’ve already got enough shit.’

I do believe more and more people are getting more savvy about money as it gets tighter, and not so much buying crap in ‘sales’ just because it says 50% off.

I do hope the global economy isn’t entirely based on us all constantly going into debt to fill our homes with stuff we don’t need, or we’re screwed as a race.

Maybe, and I’m being optimistic, people are thinking about the whole ‘recycling’ thing, and not replacing their cars, furniture, TVs and white goods, just because a new model came out that was listed as ‘in’ in the sunday supplements.

Reactions: Twitter, blogs

-

Liberal Conspiracy

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q

-

Lee Hyde

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q

-

Shaun Gardiner

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q

-

sunny hundal

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

neilrfoster

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Roger O Thornhill

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Caroline McAllister

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Jill Hayward

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Rich

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Paul Trembath

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Chris Paul

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Diane Lawrence

RT @libcon: Will today be the day people start to question Osborne's competence? http://t.co/0mkBv9N

-

Sean Livesey

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

MervynDinnen

RT @sunny_hundal: Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Huw Davies

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q

-

Stephenie Claire

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

False Economy

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

AnonLegionGR

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

bob woods

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

Tony Dowling

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

Mike Simpson

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q

-

Sooper8

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

Martin Johnston

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

Liz Todd

Will today be the day politicos finally start to question Osborne’s economic competence? http://bit.ly/qdWt5Q

-

Phillip Tilley

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

David Marsden

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

Ian Statham

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q

-

sunny hundal

Will tomorrow be the day politicos start to question Osborne’s economic competence? http://t.co/8jmSPFb (figs not out today as said earlier)

-

James Leppard

Will tomorrow be the day politicos start to question Osborne’s economic competence? http://t.co/8jmSPFb (figs not out today as said earlier)

-

paulstpancras

Will tomorrow be the day politicos start to question Osborne’s economic competence? http://t.co/8jmSPFb (figs not out today as said earlier)

-

Derek Bryant

Will tomorrow be the day politicos start to question Osborne’s economic competence? http://t.co/8jmSPFb (figs not out today as said earlier)

-

Martin McGrath

Tomorrow is a big day for the boy George and his economic "plan" http://bit.ly/nvJMv2 @libcon

-

Stephen

Will tomorrow be the day politicos start to question Osborne’s economic competence? http://t.co/8jmSPFb (figs not out today as said earlier)

-

Huston Gilmore

Will tomorrow be the day people start to question Osborne’s competence? http://t.co/qC0ynyf via @libcon < start questioning? #ToryCuts

-

SSP Campsie

Will tomorrow be the day politicos start to question Osborne’s economic competence? http://t.co/8jmSPFb (figs not out today as said earlier)

-

Jackart

Yes, @sunny_hundal http://t.co/hvuwSBj but the fiscal multiplier is LESS THAN 1. This c'ld be an argument for more spending cuts & a tax cut

-

Jackart

& could the endless scaremongering by the likes of @sunny_hundal about "cuts" be the reason for the fall in confidence? http://t.co/hvuwSBj

-

Bristol NUJ

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q (via @libcon) #falseeconomy

-

Owen Blacker

Will tomorrow be the day politicos start to question Osborne’s economic competence? http://t.co/8jmSPFb (figs not out today as said earlier)

-

Mönk

Question Osborne’s competence? The graph sayit all!!!

http://t.co/nSzXr1r -

Mönk

Question Osborne’s competence? The graph says it all!!!

http://t.co/nSzXr1r -

Pam Field

Will tomorrow be the day people start to question Osborne’s competence? | Liberal Conspiracy http://t.co/9OAwL3y via @libcon

-

Graham Jeffery

Will tomorrow be the day people start to question Osborne’s competence? | Liberal Conspiracy http://t.co/Dr4EPer #ConDem

-

Alex Bellars

Will tomorrow be the day people start to question Osborne’s competence? | Liberal Conspiracy http://t.co/Dr4EPer #ConDem

-

Stephe Meloy

Will today be the day people start to question Osborne's competence? http://bit.ly/qdWt5Q

Sorry, the comment form is closed at this time.