The parallels between Barclays and News International

8:40 am - June 29th 2012

| Tweet | Share on Tumblr |

The parallels between News International and Barclays are obvious. Both were/are arrogant, strutting companies, ran by arrogant, strutting individuals who believed that they were above the law.

Both believed that they could either deride or injunct their critics, protected as they were by their connections with the most powerful in society.

Both believed that they could obfuscate their way through a period of trouble: whether it was countless NI execs and editors claiming their problems were all the fault of one rogue reporter, or Bob Diamond saying first that the time for apologies was over.

If it hadn’t been for the Guardian, it’s unlikely that News Corporation would have announced splitting the publishing side of the business from that of broadcasting.

It can only be hoped the same happens to those responsible at Barclays. The chief executive at the time of the fixing of the Libor rates, John Varley, was incredibly being spoken of as the next governor of the Bank of England.

Bob Diamond, the current CEO, was the head of Barclays Capital when those underneath him were swapping emails talking of opening bottles of Bollinger in return for favours in manipulating the rates.

Barclays, it should be remembered, only avoided being directly bailed out by the taxpayer due to it raising funds from the Qataris, although it still depended on guarantees from the British state at the same time.

The fine from the Financial Services Authority of £59.5m, despite being the largest ever imposed by a regulator pales when compared with the £170m levied in the US. The irony of the home of capitalism red in tooth and claw being far tougher on corporate crime than this supposed more social democratic nation is no longer amusing, just outrageous.

George Osborne can blame Labour all he likes, but he was the one complaining back in 2006 that regulation was increasing and threatened London remaining the financial capital of the world.

The case for the splitting up of the retail and investment parts of the banks is now unanswerable, and if Osborne wants to remembered for something other than creating a double dip recession, bringing the City to heal would be it.

| Tweet | Share on Tumblr |  |

'Septicisle' is a regular contributor to Liberal Conspiracy. He mostly blogs, poorly, over at Septicisle.info on politics and general media mendacity.

· Other posts by Septicisle

Story Filed Under: Blog ,Economy

Sorry, the comment form is closed at this time.

Reader comments

Change this to “The parallels between Barclays, News International and Rangers FC” and you’ve got the perfect trifecta of modern capitalist corruption at its most crass, entitled and unapologetic.

There are probably some things worth pointing out.

“The parallels between News International and Barclays are obvious. Both were/are arrogant, strutting companies, ran by arrogant, strutting individuals who believed that they were above the law.”

Well yes and no. A company can’t be arrogant. Just as your toaster can’t be arrogant. The individuals can and many in this case were. However I don’t see how you suggest they are above the law. Last time I looked people from News International had been arrested, an inquiry was on going, and there may very well be prosecutions in banks. If there is evidence to prosecute they will. This is no different from a non-powerful, wealthy individual. A prosecuting authority will only prosecute where they have the evidence to do so. This is the case for a petty thief, or CEO of a company. If no evidence, the trial will not proceed. The only reason you hear about the cases with CEO’s is that it is high profile. It happens every day up and down the country with fraudsters, rapists, robbers, thieves, etc, etc.

“Both believed that they could either deride or injunct their critics, protected as they were by their connections with the most powerful in society.”

Hows that worked out for NI and Barclay’s then? You would be an idiot to believe that a govt. connection wont sell you down the river in a heart beat if it means winning approval.

“If it hadn’t been for the Guardian, it’s unlikely that News Corporation would have announced splitting the publishing side of the business from that of broadcasting.”

Load of cobblers. Don’t know where you are getting this.

“It can only be hoped the same happens to those responsible at Barclays. The chief executive at the time of the fixing of the Libor rates, John Varley, was incredibly being spoken of as the next governor of the Bank of England.”

If there is evidence showing individual responsibility then they will be. Otherwise there won’t. I don’t want to live in a society though that ignores the requirement of evidence and puts someone on trial because there is a baying mob at the door.

“Bob Diamond, the current CEO, was the head of Barclays Capital when those underneath him were swapping emails talking of opening bottles of Bollinger in return for favours in manipulating the rates.”

Note, Barclay’s capital and Barclay’s are run seperately. If Diamnod had turned up and said to Barclay’s retail, “I want to see emails” they would have told him to piss off. This is a bit like the manager of fresh and easy in the states coming over to England and telling Tesco’s that he believes there is a problem and that he should investigate. Its a bit mad. It is also worth considering whether senior management had knowledge of these dealings. There is not an absolute duty to know everything that happens in a company. Such a requirement would be unworkable, however what they will look at is whether there was reasonable protection in place. Hardly seems appropriate to immediatly hold executives responsible for all their employees faults, no matter the consequences. We dont know these consequences, and certainly they will be looked at.

“Barclays, it should be remembered, only avoided being directly bailed out by the taxpayer due to it raising funds from the Qataris, although it still depended on guarantees from the British state at the same time.”

Why does that make a difference? Thats the Qataris issue not ours, and the guarantees you speak of havn’t been needed, so Barclay’s hasn’t cost us a penny.

“The fine from the Financial Services Authority of £59.5m, despite being the largest ever imposed by a regulator pales when compared with the £170m levied in the US. The irony of the home of capitalism red in tooth and claw being far tougher on corporate crime than this supposed more social democratic nation is no longer amusing, just outrageous. ”

The fines are immensly complex, and I suggest that the details of how this was assessed be examined before making snap judgments. Remeber that the way Libor is set sees higher liability trades through the US.

“George Osborne can blame Labour all he likes, but he was the one complaining back in 2006 that regulation was increasing and threatened London remaining the financial capital of the world.”

But it was Labour who bailed the banks out. Sorry but Gordo and co, including Balls don’t really have the authority to comment on financial affairs. Unfortunately it seems that very few MP’s nowadays have the economic sense of a dog, let alone someone who can run the country effectively. And don’t start blabbering on about Labour alternative…its just the same s**t, different face.

Here they come – the apologists for corruption. Pathetic.

By the way, a company is not like my toaster. A company is a legal person that can make contracts and own property. My toaster can’t buy a house, even if it has the money.

@3. James from Durham

I am not apologising for them. If people are prosecuted and found guilty they should have the book thrown at them. But no matter the crime, and no matter the person I ask for a fair trial where adequate evidence to prove guilty is placed before a defendant.

A company is a legal fiction. It is only given a ‘personality’ to facilitate ownership, but it can neither own property (that is the property of the shareholders) nor sign contracts (that is done by representatives who have a duty to that company). Again companies are not arrogant. People in them can be. If you don’t follow, please explain how a company, as opposed to the people in them are arrogant.

@ James From Durham

“Here they come – the apologists for corruption. Pathetic.”

I don’t see any. Did you read the comments before commenting on them?

@ Freeman

You are being disingenuous. Companies have a legal personality; it may be “a fiction”, but if a company is found culpable and is required to pay a fine, they don’t take the money directly out of the paypackets of the people who sign the contracts, or all the employees collectively, they require the company to pay it.

It is quite possible for companies as entities to be arrogant, or naive, or foolhardy..or any number of other attributes; as collective entities made up of many individuals operating through more or less complicated processes, rules and social conventions, the concept of the “ethos” or personality of a company is hardly novel.

Yes, if individuals are proven to have broken the law they should be punished, but you aren’t going to recover the full proceeds of their alleged criminality by pursuing the individuals alone. The fines imposed on Barclays may seem large, but they reportedly represented 10% of the amount the rate fixing earned them; in how many other situations would the wrong-doer get to keep 90% of the proceeds I wonder?

@6. Galen10

“they don’t take the money directly out of the paypackets of the people who sign the contracts, or all the employees collectively, they require the company to pay it.”

Of course they do. It may not be a simple transaction but that is exactly where the money comes from. Having to pay a fine will mean that money is no longer at the disposal of the company. They will be unable to invest it, recruit with it, spend on capital with it, distribute it to shareholders. All income of a company is the ultimate possession of a person. Not a share certificate. It is those people who are affected.

“It is quite possible for companies as entities to be arrogant, or naive, or foolhardy..or any number of other attributes; as collective entities made up of many individuals operating through more or less complicated processes”

No, you refer to the people in those companies. You don’t see share certificates walking down the road mouthing off at people about how rich they are, or how clever they are. You seem to be taking exception to a statement that is really rather small and simply pointed out that a ‘company’ as a business, cannot be arrogant, the people in it can act arrogantly, and that can produce an arrogant brand, but that does not make the company arrogant. In any event it is a rather small matter to worry yourself about. I think there are far more dangerous examples of arrogance in govt….yes both sides of the benches.

“Yes, if individuals are proven to have broken the law they should be punished, but you aren’t going to recover the full proceeds of their alleged criminality by pursuing the individuals alone. ”

You rarely ever do. In all types of crime there is ALWAYS someone out of pocket. That is simply how it works and it is mad to try and stomp out all lose, or obtain perfect recovery. It is simply not possible. Not to mention that the gains to a lot of these trade will have already be distributed through-out the banking network, meaning mortgages, borrow, pensions, etc, etc. It is literally impossible to pick through all of it in our lifetimes and would lead to penalising people who had nothing to do with the trades.

Interesting that the LIBOR rate is not set by the BBA or any other British insitution, but by Thomson Reuters, an American company headquartered in New York. How reassuring – after all, Yankee corporations can be relied upon to look after our interests, can’t they?

@7 Freeman

“You seem to be taking exception to a statement that is really rather small and simply pointed out that a ‘company’ as a business, cannot be arrogant, the people in it can act arrogantly, and that can produce an arrogant brand, but that does not make the company arrogant. In any event it is a rather small matter to worry yourself about. I think there are far more dangerous examples of arrogance in govt….yes both sides of the benches. ”

At least TRY to be coherent; if a company can’t be arrogant, neither can a government!

Yup, good piece. This is the New gilded age. And it is going to get a whole lot worse. The vultures who are funding Romney are very small in number but the money they can throw at buying elections is (thanks to the supreme court) infinite. The Koch brothers alone have pledged more money than McCain got altogether in 2008. But even if they lose they have thrown a few crumbs to Obama to keep in line.

Republicans/Democrats/tories/lib dems/new labour they are all puppets for the elites. The game is rigged, just like all markets.

Oh and by the way does anyone else think Murdoch’s move to split his company is just a typical manoeuvre to let the politicians let him take over Sky like we know they want to?

It isn’t “set” by Reuters.

They collect the submissions from the banks, calculate the rate according to a fairly simple mechanical set of rules, then publish it.

http://www.bbalibor.com/bbalibor-explained/the-basics

christ…

“the company is arrogant” is shorthand for saying, “the company acted in such a way that if it was a person we would describe him as arrogant”.

@12. ukliberty

Why did the author of the article make the distinction? Think people are getting a little wound up over not a lot.

There are far more important issues being discussed here.

@13 Freeman

No doubt the author can speak for himself (or herself), but any reasonable person would, as ukliberty pointed out, have been able to make the cognitive leap that by describing the actions of the bank as arrogant, it was accpeted shorthand for the arrogant actions of individual employees and the cultural ethos which this created, and within which the actions took place.

You seem to be the one hung up on semantics, cavilling aabout whether companies are “real” or not…. and then contradicting yourself by assigning the same characteristics to governments, which in this sense are no different.

The important issues being discussed are intimately bound up with the arrogant attitudes of both the individuals, but also the company culture which they helped to creat, and within which they operated. It isn’t rocket science.

The ability of the human brain to see patterns and parallels is truly astonishing, especially if those patterns confirm existing prejudices. Let me introduce you to the Texas sharpshooter fallacy. http://en.wikipedia.org/wiki/Texas_sharpshooter_fallacy

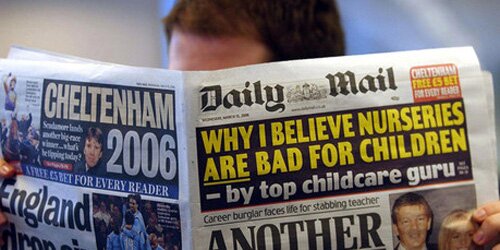

There is no parallel because they are entirely different things and you only see a parallel because you want to see a parallel. What has astonished me over the last four years is how people who are generally diametrically opposed can see the exact same things with regard to the economy and wider finance and conclude that it confirms what they always wanted to believe. Any event leads the Telegraph commenters to believe that their prejudices are confirmed and the exact same event will lead the Guardian cifers to believe their prejudices are confirmed with the opposite conclusion. Clearly both can’t be right. I think it is a form of mass delusion caused by the incredibly biased and distorted way the UK press present information.

” The chief executive at the time of the fixing of the Libor rates…”

I think it is incredibly important to make the distinction that the evidence points to Barclays Libor submission not being a true reflection of their creditworthiness, rather than actually fixing Libor. One bank could not rig Libor, and if their submission was well out of line with other submissions it would not be included in the trimmed average. Moreover, submissions during the heart of the financial crisis in 2008 could only ever be a subjective opinion because there was no functioning market for unsecured funds. Virtually the entire unsecured money market had frozen.

“Any event leads the Telegraph commenters to believe that their prejudices are confirmed and the exact same event will lead the Guardian cifers to believe their prejudices are confirmed with the opposite conclusion. Clearly both can’t be right. I think it is a form of mass delusion caused by the incredibly biased and distorted way the UK press present information.”

That is very accurate. Almost every time an unexpected news event happens the reaction tends to be:

“These tragic events prove the folly of policy X/behaviour of X has been irresponsible. They further prove that if my preferred policies are not adopted immediately, then further tragedies of this nature will happen again”

Freeman,

There are far more important issues being discussed here.

Correct, but you’re the guy who objected to the use of arrogant!

Let’s move on, shall we?

The ability of the human brain to see patterns and parallels is truly astonishing, especially if those patterns confirm existing prejudices. Let me introduce you to the Texas sharpshooter fallacy. http://en.wikipedia.org/wiki/Texas_sharpshooter_fallacy

I can counter that with the fallacy fallacy:

http://www.fallacyfiles.org/fallfall.html

One of my ‘symptoms’ is apophenia and I’m very conscious about the way my mind imposes patterns on random data. I’m also conscious that I have a high degree of pattern recognition when it comes to picking meaningful patterns out of background noise. That’s simply an exaggeration of what most people do anyway.

http://en.m.wikipedia.org/wiki/Apophenia

And the Texas sharpshooter does not apply to analogies. Septicisle begins the article by stating that there are ‘parallels’ to be drawn between Barclays and News International, not that Barclays and News International are the same thing.

A further similarity is that while NotW and Barclays have taken the hit we all know that many other companies in the industry were doing exactly the same. Will the other banks get away with it like some newspaper did?

“The case for the splitting up of the retail and investment parts of the banks is now unanswerable,”

Where did that come from? What on earth has attempting to fix Libor got to do with the separation of investment and retail banking?

@15. Richard W: “The ability of the human brain to see patterns and parallels is truly astonishing, especially if those patterns confirm existing prejudices.”

I follow your argument that biases may lead us to attribute reason or cause incorrectly. Logically, if employees of Barclays thought that they could mislead Libor or other financial institutions, we should assume that other banks would try the same tricks. Therefore we cannot attribute it to a Barclays culture because we do not know at this time who else has been accused. Perhaps the other offenders are quiet, conservative New Englanders who would never do “flash”.

However the parallels between consequences cannot be dismissed. We know what happened at NI where the mutterings are that it seeks a sale or complete division of press and broadcasting brands. NI lost so much consumer confidence in NOTW that it closed the title. And at Barclays, they’re facing massive disbelief and mistrust. The lesson is that if you play a dirty game and get caught, the consequences are extreme.

Incidentally, a consideration of Leveson might be that NI newspapers were not the only ones to abuse personal privacy or the most egregious. But they were the first to come under the spotlight and have suffered most in the eyes of investors and consumers. A company may not be the only offender, but being the first to be caught may make it seem that way.

Tim: What hasn’t it got to do with it? The mounting charges of misselling PPI and now interest rate swaps alongside the Libor fixing is just further evidence of how the culture in one side of the business was infecting the other. Mervyn King is calling for a change; the best way to achieve that is for the split to happen.

“Last time I looked people from News International had been arrested, an inquiry was on going, and there may very well be prosecutions in banks. If there is evidence to prosecute they will”

But it took many years for this to happen and the suspects continued to act as if they would never be arrested or cautioned by the police. .Why did NoW get deeply involved in the Milly Dowler case? Because it was fairly sure that the police woldn’t tell them to back off. Because on countless previous occasions the pollice hadn’t told them to back off. And now (many years later) the police are being investigated for why they didn’t tell the NoW to back off. There may be prosecutions now, but for many years there was evidence but no prosecutions.

@23. Guano: “Why did NoW get deeply involved in the Milly Dowler case? Because it was fairly sure that the police woldn’t tell them to back off. Because on countless previous occasions the pollice hadn’t told them to back off.”

Apologies for the distraction from the Barclays story.

The reasons why the police did not tell the NOTW to cool down are twofold:

1. The police has used the press as an investigative tool for years. We can assume that it had already been established before Jack the Ripper. The police use the press formally (eg press conferences, press releases) and informally (officers disclosing information to people [insiders and outsiders] not involved in the investigation, which has not been published).

2. The police cannot control the data that it holds about investigations.

There is an excellent PhD project to determine whether or how the police are efficacious when revealing crime data in public form. And on point 2, we have to address an institutional failure.

Charlieman: I am unsure what point you are tryng to make.

There have been institutional failures: ie watchdogs have failed to bark, institutions have failed to investiagte and put on trial criminal behaviour. This would appear to be because the informal institutions (the relations between police, newspapers and politicians) have been stronger than the formal ones. The police have used the press to try to cover up their mistakes (eg the death of Jean-Charles de Menezes) and the police have not intervened when the press got involved in cases while in search of a story. There has been plenty of evidence of crimes without a proecution being contemplated until sufficient publicity was generated: up until that point “it wasn’t a story”.

Freeman @2:

“Note, Barclay’s capital and Barclay’s are run seperately. If Diamnod had turned up and said to Barclay’s retail, “I want to see emails” they would have told him to piss off.”

Why is this relevant? The bad stuff we’re talking about went on in Barclays Capital, not Barclays Retail.

Regards

Luke

Reactions: Twitter, blogs

-

Liberal Conspiracy

The parallels between Barclays and News International http://t.co/GLlnO1Gr

-

Lesley Bruce

The parallels between Barclays and News International | Liberal Conspiracy http://t.co/Lq6OYDio

-

Jason Brickley

The parallels between Barclays and News International http://t.co/Ate28uQ9

-

leftlinks

Liberal Conspiracy – The parallels between Barclays and News International http://t.co/rKhBNF9z

-

Lambeth NUT

The parallels between Barclays and News International http://t.co/GLlnO1Gr

-

Ray Sirotkin

The parallels between Barclays and News International http://t.co/GLlnO1Gr

-

DPWF

The parallels between Barclays and News International | Liberal Conspiracy http://t.co/Q60AxBLz

-

Clive Burgess

The parallels between Barclays and News International http://t.co/GLlnO1Gr

-

Natacha Kennedy

#Diamond and #Murdoch should both be in jail. http://t.co/fjKtYt1R via @libcon

-

Jane Brown

#Diamond and #Murdoch should both be in jail. http://t.co/fjKtYt1R via @libcon

-

letsnotbecynical

The parallels between Barclays and News International | Liberal Conspiracy http://t.co/p9sVfZWS via @libcon #newscorp #murdoch #banks

-

BevR

The parallels between Barclays and News International | Liberal Conspiracy http://t.co/nJ8hJ7YV via @libcon

Sorry, the comment form is closed at this time.

NEWS ARTICLES ARCHIVE