The 50p tax will raise more than £6billion according to HMRC itself

1:38 pm - March 9th 2012

| Tweet | Share on Tumblr |

I have written a new report for the TUC is entitled ‘Is 50/50 fair?’. It does, of course, discuss the 50p tax rate.

The key conclusions are easily stated though. The first is that using HM Revenue & Customs’ own data the 50p tax rate has potential to raise a sum well in excess of the £3 billion last officially forecast, and a figure at least as high as £6 billion could be generated.

That estimate, it is stressed is for 2011/12, not 2010/11, when HMRC clearly expected some transitional avoidance. But it’s hard to see how the tax could not raise such sums.

Second, I argue that the scope for revenues to fall as a result of the use of this rate is far smaller than claimed by many, especially since almost 60% of those paying this tax rate are employees for whom avoidance opportunities are, to be candid, often quite limited

No doubt some will blame it for their reason to relocate when it is likely a wide range of other factors will also actually be involved in that decision.

Finally, I argue that whilst there are still routes open to those who seek to avoid paying tax at the 50p rate which do have potential to undermine the revenues that it could raise this loss of income to the Exchequer is not inevitable.

These routes could be easily closed if the political will existed to introduce both a comprehensive general anti-avoidance principle in UK tax law and to tackle the issue of personal service companies to ensure that the profits of these companies were assessed on their owners at the time they arise and not at the time that they are paid out to them, as now.

The figure I have estimated is that this tax will raise at least £6 billion in revenue in the tax year 2011/12. The calculation is, however, not really mine. This is H M Revenue & Customs’ estimate. I have based my figure on HMRC’s estimates of tax revenue to be raised by tax band for 2011/12, here.

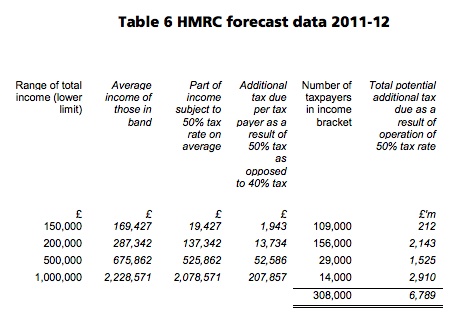

I extrapolated this data as follows:

Note my resulting total is £6.8 billion. I’ve downgraded it to £6 billion to be cautious. But this is still HMRC’s data. It is their estimate of the average income of those in each of the tax brackets.

It’s their estimate of the number of taxpayers. It’s their estimate of total income. So candidly, this is really their estimate of the tax to be raised. And it’s big – much bigger than anything else anyone has said.

To put it another way: the 50p tax rate is highly likely to be both fair and contribute significantly to UK tax revenue whilst encouraging long overdue steps to stop abuse in our tax system. for all those reasons it has to be welcome.

| Tweet | Share on Tumblr |  |

Richard is an occasional contributor. He is a chartered accountant and founder of the Tax Justice Network. He blogs at Tax Research UK

· Other posts by Richard Murphy

Story Filed Under: Blog ,Economy

Sorry, the comment form is closed at this time.

Reader comments

In his memoirs, Blair actually admits that he privately supported Lawson’s 1988 decision to cut the top rate of tax to 40%–something that Thatcher was very nervous of doing.

And ever since, of course, Blair used any excuse he could think of not to raise it.

But, of course, he could not admit the real reason–I intend to make a lot of money after leaving office and I wish to pay as little tax as possible on it.

The excuse now is that it doesn’t raise much money. But $3 billion is not a small amount really. People will get round the 50p rate—sounds like a good argument for closing such loopholes to me.

It looks like the Liberal Democrats are going to cave in on this issue as on so much else.

It’s great to see these numbers. I think people overestimate the lost revenue in a 50% tax on additional income over £150,000. In reality, most people won’t move abroard or avoid paying their taxes. It’s really down the ethics of the people involved, and if the government can actually close the laughable loopholes in the tax system for highearners, then I’m tax revenue could be a lot higher than it is under the 50p tax (though any higher than that is too high, in my opinion).

The extra £3bn comes purely from those earning over £1m who are being asked to pay on average another £208k per year. If we assume that those will move their tax overseas then £6bn falls apart immediately.

You can argue about the ethicalness of that but you can also ask about the ethics of taking more than half of a person’s earned money. And ignoring the ethics, we’re actually trying to discuss reality.

For those of you who say we should close tax loopholes, show me how you close the following loophole without becoming protectionist or authoritarian:

I set up a company in a tax haven and then give up my job and get my company to take services from that overseas company.

What do you do to block that? Other than block trade with those countries who tax systems we don’t agree with? Perhaps you say we block trade with only tax havens but then you just set it up in America or somewhere with much lower taxes that aren’t havens.

The only real way to collect taxes is on consumption and/or wealth in the UK.

“but you can also ask about the ethics of taking more than half of a person’s earned money.”

You can also ask whether saying a 50% rate on income above 150k constitutes “taking more than half of a person’s earned money” is mathamatically correct.

Mr Murphy’s article talks about the marginal tax raised whereas the reality is very different. What is happening is that at the top end these people are moving into a mixture of; service contracts, off shore and “payment in kind” etc.

That loses in some cases ALL the income tax not just the marginal parts. So a chase for £6bn puts on the line over £30bn in all taxes (with NI Vat etc). On Murphy’s figs if only half of the folk not directly employed do these moves the losses are potentially over £7bn. As each year goes by a higher % of people will modify their arrangements and fall out of the tax net. It will just get worse.

Back to school for socialist taxation.

But Harry: surely most of those intending to do that will do it anyway, regardless of the actual tax rate. There’s still a pretty powerful incentive to avoid at 40%. Logically, your argument leads to giving up entirely trying to tax anyone (or any company) wealthy enough to find legal ways to avoid tax. That’s basically what Greece did, I believe.

Once a certain proportion of people and companies dodge tax, it becomes normal, and everyone has to do it to keep up. The whole tax burden ends up falling on a narrow (and angry) slice of society earning just enough to pay taxes but not enough to avoid taxes. They’ll either take their rage out on the poor or the rich. I don’t think I want to do the experiment to find out which they’ll choose.

The hassle of trying to block tax haven activity suddenly starts to look not so bad after all. Even if we can only block some of it, it strikes me as worth doing. The amount of legitimate trade with the Cayman Islands and Liechtenstein probably isn’t large…

It will not raise £6 billion “according to HMRC”, as the headline states. You have taken figures which do come from the Treasury and performed your own calculations which gave you the £6 billion figure. In the full report, from which table six above is taken, you state “data in italics are authors own calculations based on HMRC data”. Note that the £6.789 billion figure is in italics.

I don’t doubt your calculations are correct, so why over-egg the pudding with a headline which doesn’t stand up?

Leaching off the rich….its going.

In the greater scheme of things six billion is neither here nor there. Our incompetent government will spend what – seven hundred billion this year? And borrow one hundred and fifty billion because tax receipts are that much short. So six billion is less than one per cent of government spending and around one per cent of taxes collected.

On the other hand our government is going to give away eleven billion in foreign aid to countries which don’t even want it like India. Indeed, the way it squanders our money is so epic I hardly know where to start. What about the – what was it? – four hundred thousand spent so far renting trees for the entrance of Portcullis House? Or one and a half billion spent trying to save four hundred million.

Instead of Richard Murphy putting so much effort into finding ever more ways of taxing us and adding to the two and half million words in Tolley’s Tax Guide, why doesn’t he expend effort on how the government could squander less of our money and borrowed money – so we all pay less tax?

One problem with the report is that the total marginal tax rate just isn’t 50%.

Richard has left out the effects of employers’ national insurance. And as his own report points out, at least 60% of these top rate payers are paid through PAYE.

And as Richard has also agreed in the past from something to all of employer’s NI is actually a tax on the workers’ wages, not a tax on hte company. That is, the incidence is on the worker.

It’s possible, certainly worth discussing, whether 50/50 is fair. But if it is that means that we need to lower that top income tax rate in order to get to that fair total marginal rate.

At which point, well done Richard for showing that the 50 p rate needs to be abolished!

Oh dear. Another article by this Brezhnev relic.

The IFS made their prediction that tax rate would cost the exchequer money based on real life data not some fantasy from the back of a beet mat at best. This is d incredibly ill informed and I mean that literally. I cannot credit that Murphy is this ill; informed

12 Paul Newman

The IFS made their prediction that tax rate would cost the exchequer money based on real life data

Um, the above seems to be “real life” HMRC data. Didn’t you notice?

Supply siders like to ignore data that doesn’t stack with their ingrained economic stupidity (which is almost all of it).

I, personally, have no objection to a 50% tax rate on top earners (I should find a 60% rate on incomes over £1 million fine) but I prefer the arguments in favour to be honest ones.

Mr Murphy, as usual, shows why he is a *retired* accountant in his mid-fifties. He is good at “creative accounting” and so collected a lot of money from clients by advising them how to avoid tax (and avoiding it himself – e.g through his personal service company).

Firstly, if your average higher-paid self-employed/private sector worker wants a pension comparable to a senior civil servant on the same pay then he/she will put aside some 25% of gross income into a pension scheme (I’m putting aside more because inflation has eroded the value of my pre-2000 savings and Mervyn King has slashed the annuity I can buy with them). Osborne has limited the tax-allowable part to £50k, but a significant number can put more aside because they have a “carry-forward”; even if they are only putting £50k each into an approved pension plan that takes £1.2bn out of Mr Murphy’s total.

Secondly, total income includes quite a lot that is non-taxable thanks to tax breaks created/increased by Gordon Brown for investment in films, “affordable housing”, ISAs, Gift Aid (every year HMRC send me a note telling me how my basic rate band is extended for Pension and Gift Aid), as well as Enterprise Investment Schemes, VCTs, redundancy payments, etc. The rich use Gift Aid a lot – the total of Gift Aid payments to charities exceed £1bn pa after tax. The tax-free income the rich get from ISAs is even greater – several £billion. EISs and VCTs are there to persuade rich people to put money into investments that wouldn’t be justified without the tax breaks, so are likely to attract higher rate not basic rate taxpayers..

Thirdly, total income includes income on which overseas tax has already been paid and is not subject to UK tax under double taxation agreements.

Fourthly, the numbers that he has added to the HMRC tables are inconsistent with HMRC data.

£6 billion is designed to provide a tabloid headline for his TUC paymasters, and should not be taken seriously by anyone planning a budget.

HMRC £3 billion estimate – a massive 2% of the deficit that Brown, via Darling, bequeathed to Osborne – is more realistic. So taxing the income of the rich will not solve our fiscal deficit – the options are to “confiscate” (steal) their wealth or to cut spending (or to use inflation to do both while pretending to do neither – but the trouble with that is that it is the little guy whose cash savings are decimated while the rich property developer using borrowed money makes a fortune).

Reactions: Twitter, blogs

-

The Old Politics

The 50p tax will raise more than £6billion according to HMRC's own data http://t.co/uOngbK1b

-

Martin Hinds

The 50p tax will raise more than £6billion according to HMRC's own data http://t.co/uOngbK1b

-

Karl Kemp-O'Brien

The 50p tax will raise more than £6billion according to HMRC's own data http://t.co/uOngbK1b

-

Just Me

The 50p tax will raise more than £6billion according to HMRC itself | Liberal Conspiracy http://t.co/nt4AcqB4 via @libcon #wrb

-

Adrian Parry

The 50p tax will raise more than £6billion according to HMRC's own data http://t.co/uOngbK1b

-

Chris Barker

“@libcon: The 50p tax will raise more than £6billion according to HMRC's own data http://t.co/2qFfwzRj” Daily Mail pls read this analysis

-

representingthemambo

The 50p tax will raise more than £6billion according to HMRC itself | Liberal Conspiracy http://t.co/VkAScpJs via @libcon

-

ConDem'd

[cr] There is much debate to be had….one thing is clear though, we need to start taxing fairer. High earners,… http://t.co/WdGjBGnB

-

Sue Thomas

The 50p tax will raise more than £6billion according to HMRC's own figures http://t.co/mDOLgv8n

-

Alan Hinnrichs

The #50ptax will raise more than £6billion according to #HMRC itself | Liberal Conspiracy http://t.co/BG9lFDiK via @libcon

-

Labour are doorstepping naked, ‘public schoolboy’ Cameron is suffering and the government isn’t loved by anyone: political blog round up for 3 – 9 March | British Politics and Policy at LSE

[…] has no merit. Richard Murphy, writing for Liberal Conspiracy, argues that the 50p tax rate will raise more than £6billion, the Coffee House believes that the Chancellor wants to set a date for the abolition of the 50p tax […]

-

Noxi

RT @libcon: The 50p tax will raise more than £6billion according to HMRC's own data http://t.co/TAJE7Mgy

-

AlmosJustice

The 50p tax will raise more than £6billion according to HMRC itself | Liberal Conspiracy http://t.co/on3z1jO4 #LibDems prefer to hit poor.

-

JC

50p tax will raise more than £6bn http://t.co/fLu4s2M4

-

James Hall

The 50p tax will raise more than £6billion according to HMRC's own data http://t.co/uOngbK1b

-

sunny hundal

@Niaccurshi @A_C_McGregor don't accept "reports" in the Telegraph. At the very least its between £3bn and £6bn http://t.co/mDOLgv8n

Sorry, the comment form is closed at this time.