How the CBI is misleading in pursuing a race to the bottom on taxes

8:30 am - April 23rd 2012

| Tweet | Share on Tumblr |

The CBI offered another piece of gross misinformationwhen launching its new tax report ‘Tax and British Business – Making the Case’ (which it spectacularly failed to do). The CBI claimed:

The long view is a revealing one. In 1982-3, the main rate of corporation tax was 52 per cent and yielded tax revenues equivalent to 2 per cent of GDP. In 2010-11, the corporation tax rate was 26 per cent, half what it was, but yielded 2.8 per cent of GDP, almost half as much again.

What they wanted people to believe, very clearly, is that UK business now pays more in tax than it did in 1982. The claim was certainly that the proportion was not falling. But this is misleading.

As they said:

The argument that tax competition is a race to the bottom in the long term is not supported.

There are two good reasons why this is misleading.

First, Nigel Lawson reformed the tax base when cutting corporation tax rates in the 1980s. In the process he eliminated automatic 100% first year capital allowances and he abolished stock relief. As a result taxable profits skyrocketed overnight.

It’s just not possible to compare tax yields after that radical reform with those before it – corporation tax before and after that event were utterly different, and there were those like John Whiting at the CBI event who knew that. The claim to make a comparison was then severely misleading.

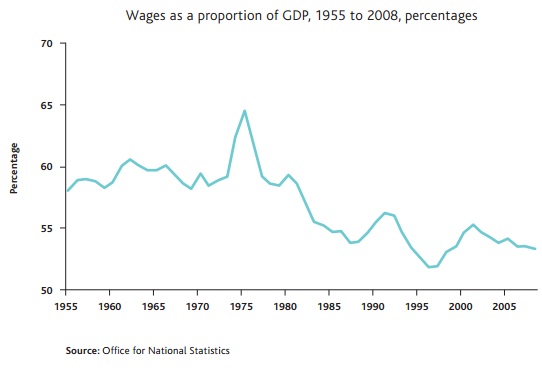

Second, the proportion of profit in the economy has increased dramatically. I’ll quote from Howard Reed writing on this issue for the TUC instead, who looked at pretty much the inverse ratio, the wage share over time:

First, there is a link to the economic cycle with the share first rising and then falling, with a lag, during recessions. For example, it rose slightly in both 1974–5 and in 1990–91 before falling back.

This may be because at the onset, profits are more sharply affected than wages. Eventually however, the wage share falls as unemployment continues to rise, firms continue to cut costs and profits recover.

Taxes on profits as a proportion of GDP have been broadly static.

But since profits are rising as a proportion of GDP that means tax a a proportion of profit is falling and that does not support the CBI claim – it contradicts it.

The labour share on the other hand has seen its share of tax rise as its share of GDP has fallen.

All this the CBI failed to point out, peddling another pack of misinformation instead and making claims about the race to the bottom that cannot be justified.

| Tweet | Share on Tumblr |  |

Richard is an occasional contributor. He is a chartered accountant and founder of the Tax Justice Network. He blogs at Tax Research UK

· Other posts by Richard Murphy

Story Filed Under: Blog ,Economy

Sorry, the comment form is closed at this time.

Reader comments

Good to see someone challenging the idea that corporation taxes should be cut at the the expense of the rest of us. No mainstream politician bothers to question it at all now.

Usual stuff, Richard doesn’t understand the economics he’s spouting.

“Second, the proportion of profit in the economy has increased dramatically. I’ll quote from Howard Reed writing on this issue for the TUC instead, who looked at pretty much the inverse ratio, the wage share over time:”

The wage share is not the inverse of the profit share.

http://uneconomical.wordpress.com/2012/04/23/uk-gdp-by-income/

Sorry, but it just ain’t true that a falling wage share means a rising profit share. There are other things in there as well.

Mr Murphy says that it is misleading to say that the amount of tax paid by business has increased when corporation tax as a share of GDP has increased by 40%. What have they been putting in his lemonade?

So Lawson reformed corporation tax to remove the massive subsidies that Healey handed out to Sainsburys and Tesco. That changed the how corporation tax was calculated and resulted in a fairer split between manufacturing industry and retailing but the CBI is looking at the total paid by business so Murphy’s claim that the figures are non-comparable is just rubbish.

“But since profits are rising as a proportion of GDP that means tax a a proportion of profit is falling and that does not support the CBI claim – it contradicts it.”

Actually what the CBI claimed, supported by data is that as the headline corporate tax rate declined the amount of tax actually paid went up both in nominal terms and as a %age of GDP. Murphy has got it completely the wrong way round. Again the lemonade query.

According to the Guardian, tax took 42% of GDP in 1974-5, according to Mr Reed wages took 64.5%, so corporate profits and self-employment income (some of which is wages and some of which is profit) amounted to MINUS 6%

Of course the share of profits has increased dramatically from minus more than 6%. The alternative would be unemployment of 60% when all the private sector firms went bankrupt. Is that really what Murphy wants?

Reactions: Twitter, blogs

-

Liberal Conspiracy

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/iCJ7wOrw

-

Jason Brickley

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/A717hrPO

-

MalcolmWing

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/iCJ7wOrw

-

Nautilus in Red

RT @libcon How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/yw1l72Eb << I wish I understood this.

-

leftlinks

Liberal Conspiracy – How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/kvPKatzw

-

BevR

How the CBI is misleading in pursuing a race to the bottom on taxes | Liberal Conspiracy http://t.co/P7Plot3E via @libcon

-

Andy S

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/4WP1euN9 (via @libcon)

-

Paul W

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/iCJ7wOrw

-

Shifting Grounds

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/qGamDveY @RichardJMurphy

-

Alex Braithwaite

How the CBI is misleading in pursuing a race to the bottom on taxes | Liberal Conspiracy http://t.co/o92XjPoY via @libcon

-

Nicholas Ripley

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/2NYldduI

-

Owen Blacker

How the CBI is misleading in pursuing a race to the bottom on taxes http://t.co/iCJ7wOrw

Sorry, the comment form is closed at this time.

NEWS ARTICLES ARCHIVE