There’s no simple way out of this economic rut, for the left or right

The economy is stuck -we’ve had nine months of near stagnation and the prospects for the next two years look grim.

In many ways we now seem to be bouncing along on at the bottom of the ‘L’.Even excluding ‘temporary factors’ (warm weather, cold weather, tsunamis and royal nuptials) the economy only managed 0.7% growth in the past nine months – a pathetic recovery.

As the NIESR have noted this is an historically weak recovery – the only real precedent being the 1930s.

continue reading… »

How the UK could pay for its demographic “time-bomb”

Many of the headlines generated by the Office for Budget Responsibility’s recent report concentrated on the challenges of the demographic “timebomb” – the fact that we are living longer.

There will be undoubtedly be extra costs, but there is no need to give in to right wing calls to slash spending.

continue reading… »

Osborne’s time is running out, even amongst friends

It’s a gentle, fragile thing the new British economy. The old cliché used to be that when America sneezed, the rest of the world caught a cold. We do things differently now.

Unexpected, truly world-shattering events like the sun deciding to beat down in April meant that instead of 0.7% growth between April and June, we instead got 0.2%.

If George Osborne isn’t much cop at spearheading a recovery which doesn’t resemble the water in the Dead Sea, then he does at least have the invaluable skill of coming up with corny soundbites.

continue reading… »

BBC goes along with govt spoiling tactic on disabled people

contribution by Steve Griffiths

Every month the Dept for Work and Pensions put out statistics purporting to show that few benefit claimants are ‘unfit to work’, with a juicy quote from a minister saying how terrible this is.

Today, the timing is immaculate: the BBC give it a higher billing than the report scathing about the Work Capability Assessment.

‘Only 7% of people claiming sickness benefits were unable to do any sort of work’, the BBC claim that ‘new figures have shown’. This is a monthly press release.

continue reading… »

Will tomorrow be the day people start to question Osborne’s competence?

Tomorrow today we find out how badly the UK economy has been doing for the past 3 months. It is important because it may also be the day politicos wake up and realise our economy is in deep trouble and George Osborne has little idea how to revive it.

By most predictions it will be a bad figure for the Chancellor: ranging from negative growth (massive disaster) to around 0.8% growth (still a disaster). As Ed Balls pointed out yesterday, Osborne needs 0.8% just to hit his targets (and bring the deficit down).

Let’s be clear about this: many of us on the left warned a year ago the Chancellor’s austerity strategy would not work. A year later, the evidence is mounting up against him.

Why the Euro deal on Greece is still likely to fail

The EU thinks it’s saved the Euro, again. It hasn’t.

This is a deal, summarised here, that to coin the current vernacular, kicks the euro down the road until the autumn, but which has no hope of delivering a real solution.

Why not?

Because, clause 1, no one knows if the Greek people will, as yet, put up with the austerity that is demanded of them. But what we can say with certainty is that the austerity demanded will not deliver growth, whatever this document claims.

continue reading… »

More than 2 million people could enter fuel poverty on a single day

I wish to start an awareness campaign for Fuel Poverty Day.

On the 1/8/2011, prices in gas will rise on average 20% and prices in electricity will rise 18%. It brings into fuel poverty families whose household incomes are £12,840-£14,440.

From the graph below I can tell you that this is more that 2million people.

continue reading… »

Has the media forgotten about our teetering economy?

The political-media establishment’s obsession with News International is distracting us from a worrying fact – that our economic prospects are deteriorating. Take these developments:

- The IMF has warned (pdf) that the euro area’s debt crisis has “potentially large spillovers” to the rest of the world economy.

- Governments in developed economies next year will engage in the largest concerted fiscal tightening for 30 years. There’s not much chance of this growing our economies.

continue reading… »

Time to really start worrying – the Euro crisis is getting worse

I might be premature (always the risk when commenting on markets) but – it looks to me like the Eurozone Bank Stress tests have utterly failed.

They are only two reasons for doing these tests – either the aim is to genuinely test if the banks are healthy enough to take possible losses and identify which banks require more capital OR the aim is simply to reassure the markets that the banks are fine.

continue reading… »

Why hedge funds do better than bent bookies

Hedge funds have got one major advantage over bent bookies. In their case, race fixing is entirely above board. Let me expand on this point, by way of an analogy for what has been happening in the Irish, Greek, Portuguese and Italian economies of late.

Let’s say you take a bet on a horse to lose the Grand National, something that those of us who do the gees gees know as a ‘lay bet’. But in this case, you get access to the paddock, and have every opportunity to bribe the jockey or dope the nag. You can even throw ball bearings, or perhaps the odd suffragette, under its hooves once it is on the track.

What’s more, the Jockey Club – a bunch of bleedin’ useless aristos who are never particularly assiduous in these matters, anyway – can’t see any harm in all this, and doesn’t even make a pretence of trying to stop it.

Osborne’s corporation tax isn’t working for the economy

Amid the ongoing News International fallout and the developing Eurocrisis, yesterday’s FT carried quite an important story on the likely failure of a key component of the government’s growth strategy.

Osborne has made boosting investment a core pillar of his economic strategy – something I entirely agree with. I have written at length on the need to boost business investment and also on the problem of the corporate surplus.

The problem is that Osborne’s preferred strategy is simply to cut corporation tax and hope for the best.

continue reading… »

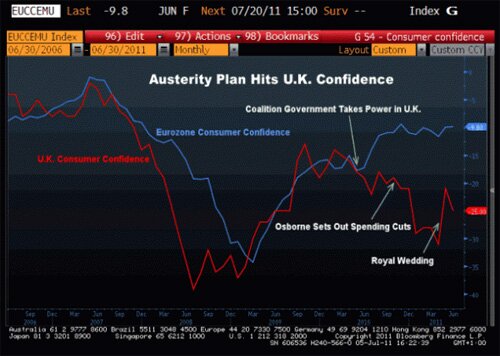

Time to start worrying? Recession fears go mainstream

Having long warned that the Government’s economic agenda risked harming Britain’s recovery, I finally stuck my neck out in April and wrote that I now thought a double dip recession was more likely than not*.

I wrote that to avoid a recession four (nearly impossible) things have to happen in 2011:

1 – The impact of spending cuts on growth has to be a lot lower than the IMF estimate them to be.

continue reading… »

BIG: UK economy ‘could be shrinking’ (updated)

Post updated in its entirety

Over the weekend, while the NotW scandal was in full swing, important news went under the radar.

The Sunday Times reported:

Britain’s economy has shrunk over the past three months, according to City experts, piling more pressure on ministers as they drive through the coalition’s programme of cuts.

Economists believe that official GDP figures later this month will reveal that the economy contracted by 0.2% between April and June, after recording growth of 0.5% in the first quarter of the year.

Official measures of GDP published by the Office for National Statistics have consistently proved even gloomier than City predictions in recent quarters.

The experts’ forecasts will revive fears that Britain will re-enter recession, which is defined as two consecutive quarters of negative growth.

George Osborne, the chancellor, may try to blame the Japanese earthquake, a late Easter and the royal wedding break. Critics will say the chancellor also blamed temporary factors for weak growth in the final quarter of last year, when unseasonal snowfall was cited.

Yes – Osborne will try and blame temporary factors again but this excuse cannot be rolled out on a constant basis.

A similar report is also in the Sun today .

So what happened to Osborne’s growth plan huh?

The Guardian reports today that prospects for Britain’s economy remain bleak as “consumers continue to cut back on their spending and export sales fail to take up the slack”.

Keep in mind that right-wingers were touting exports as our way out of the slump only a few months back. The idea this was going to happen was always a fantasy but it nevertheless became a serious talking-point on the right.

The Guardian also says a report from accountants BDO shows business confidence in the manufacturing sector has dropped to a two-year low.

On top of declining demand at home, as the coalition’s tax rises and spending cuts take hold, firms are facing a slowdown in exports, especially to the eurozone, as it struggles with its sovereign debt crisis.

Osorne’s plan to cut spending and make consumers even more fearful of future prospects really worked didn’t it?

I wonder how long it will take tories to admit we should have taken measures to hold domestic demand and confidence.

Meanwhile, our economic growth prospects are tanking

Yesterday’s news that NIESR is forecasting growth of only 0.1% in the second quarter reminds us of quite how bad things currently are in the UK.

The Sunday’s David Smith has today referred to growing talk in the City that the number may even be negative.

This is all a far cry from the situation only 6 months ago – before the shock decline in Q4 2010 GDP was reported at the end of January.

continue reading… »

Should lefties like Tescos?

Middle class lefties should pipe down when it comes to supermarkets. Decent, affordable food is an old socialist goal to be applauded, not opposed.

Thus starts New Labour pressure group Progress’ article on the joys of Tesco. And it continues in the same Guardian-baiting vein: Tiffany Rose designer wear… Sabatier carving knives… vegetarian restaurants… Hampstead liberals… chi-chi delicatessens… organic butchers… and so on and so forth, reminding us all that only the Hoorayest of Henries would harbour suspicions of Tesco’s benevolent schemes for the enrichment of humanity.

As I’ve noted before, arguments that come this heavily-larded with pre-emptive insults are usually attempting to smuggle some form of horseshit or other past the reader.

continue reading… »

Yes, we do need a ‘new patriotism’

Last week Labour MP Jon Cruddas and academic Jonathan Rutherford wrote an article for the Guardian titled ‘Labour must fashion a new patriotism‘. They said:

We are an immigrant nation. There is no going back and we must find ways of living together and creating a new vision of England. We demand that migrants must be like us. But who actually are we? They must share our British values. But what are they? Newcomers must answer correctly the citizens test. But could we?

I think this is spot on.

continue reading… »

Just to make ends meet now requires around £18k a year

contribution by Chris Goulden

Since 2008, the Joseph Rowntree Foundation has been publishing its annual Minimum Income Standard for the UK, which shows how much money you need for an acceptable standard of living. This standard is based on the items and activities that a cross-section of ordinary members of the public agrees is needed to survive and take part in today’s society.

This year’s update highlights some surprisingly big increases in what people need to earn just to make ends meet.

It is clear that many millions of people in the UK do not manage to reach the standard and – for working families with children in particular – it’s getting much harder to do so.

continue reading… »

What does the Dilnot Report propose exactly: a primer

contribution by Dr Emma Stone

Today sees the launch of the Dilnot Commission’s report on how to reform the funding system for adult social care. What does it propose, what does it mean?

The key proposal: a social insurance model with an excess

The centrepiece of the reform package is a proposal to share the costs of care in later life between individuals and the state, with individuals paying for their own care until they reach a ‘cap’, after which the state pays for their care.

The Telegraph doesn’t try being a broadsheet when attacking pensions

I’ve read a story in the Telegraph with the headline: “Retired civil servants outnumber those working”.

But how’s this for the sub-head:

Retired civil servants drawing gold-plated taxpayer funded pensions now outnumber those employed in the civil service for the first time.

Four myths about ‘gold-plated’ public sector pensions

contribution by Alice Hood

It seems like a good time to debunk some public service pension myths.

Myth 1: Public service pensions are gold-plated

Half of public sector pensions in payment are less than £5,600 a year. In local government half of pensioners get less than £3,000.

continue reading… »

You can read articles through the front page, via Twitter or RSS feed.

» How the UK could pay for its demographic “time-bomb”

» Osborne’s time is running out, even amongst friends

» BBC goes along with govt spoiling tactic on disabled people

» The ‘madness’ of terrorism and other offensive terms

» Palestinian children routinely jailed for throwing stones, report finds

» What are people like Melanie Phillips calling for then?

» Anders Breivik wasn’t a “lone wolf”, he was part of a movement

» The famine in Somali is no natural disaster

» Will tomorrow be the day people start to question Osborne’s competence?

» The inequality rarely mentioned in Westminster: Scotland’s land

» How child-beating teachers were STOPPed 25 years ago

|

41 Comments 193 Comments 31 Comments 77 Comments 44 Comments 220 Comments 45 Comments 108 Comments 466 Comments 73 Comments |

LATEST COMMENTS » Lee Griffin posted on There's no simple way out of this economic rut, for the left or right » Robert posted on Cameron aide pushes wacky ideas for growth » Robert posted on Cameron aide pushes wacky ideas for growth » Brian Pelan posted on Exclusive: NGO workers dispute allegations against Johann Hari » Brian Pelan posted on Exclusive: NGO workers dispute allegations against Johann Hari » Primly Stable posted on Cameron aide pushes wacky ideas for growth » Leon Wolfson posted on Fox TV: Oslo terrorist couldn't be a Christian » Leon Wolfson posted on Cameron aide pushes wacky ideas for growth » Leon Wolfson posted on How the UK could pay for its demographic "time-bomb" » Elaine S posted on Oslo terrorist cited Melanie Phillips in his manifesto » Larry posted on Fox TV: Oslo terrorist couldn't be a Christian » Leon Wolfson posted on There's no simple way out of this economic rut, for the left or right » Thomas Stewart posted on Cameron aide pushes wacky ideas for growth » Steve posted on BBC goes along with govt spoiling tactic on disabled people » Leon Wolfson posted on There's no simple way out of this economic rut, for the left or right |